How to Calculate Stock Splits in the Indian Stock Market

Learn how stock splits work in the Indian stock market. Get formulas, examples, and strategy tips to calculate and profit from share splits smartly in 2025.

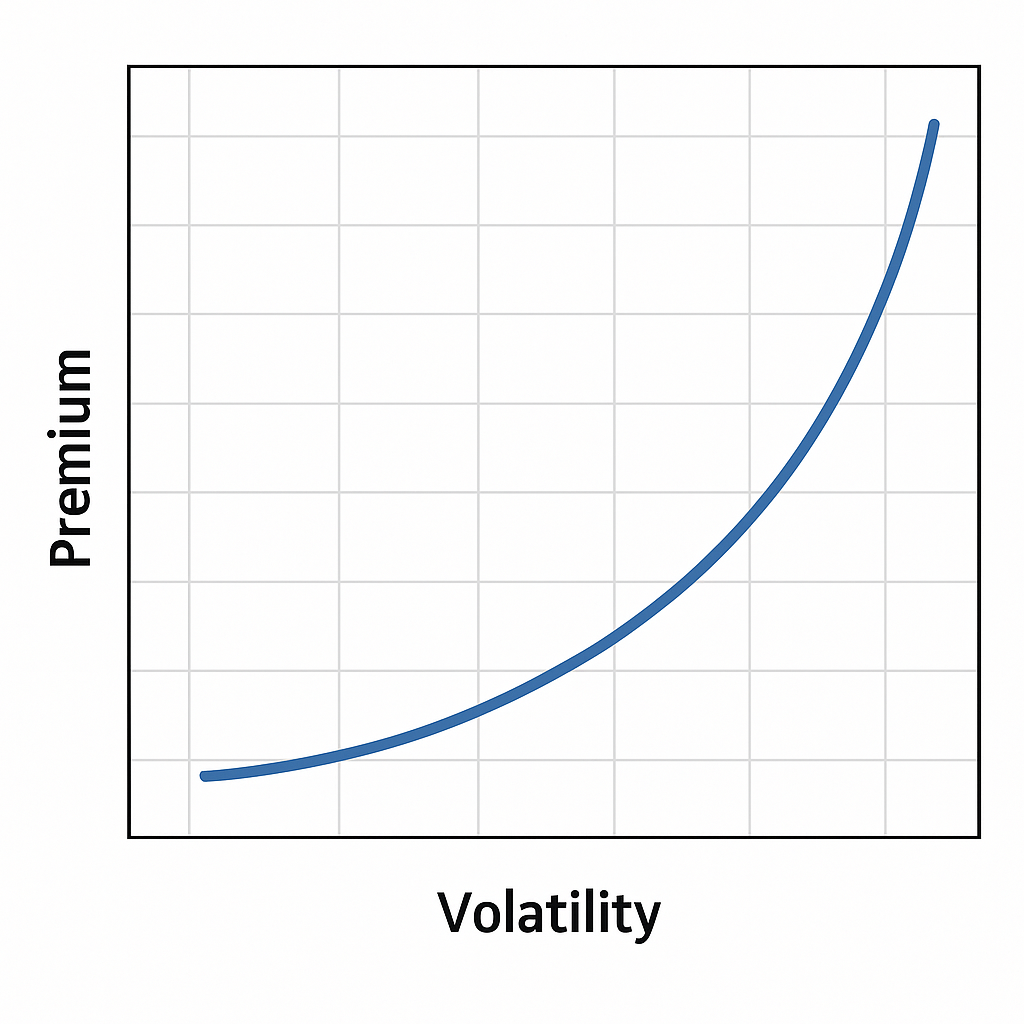

Volatility Isn’t the Enemy—It’s an Opportunity Zipper

Volatility isn’t chaos. It’s compression before expansion. Smart investors don’t run from swings—they capitalize on them. In India’s evolving equity markets, stock splits are more than price dilution events—they’re strategic signals.

Stay nimble. Hedge intelligently. With crude flirting with supply risks (20% of global oil flows threatened at the Strait of Hormuz) and inflation tamed (for now), your capital needs agility, not rigidity.

What is a stock split?

A stock split occurs when a company increases the number of its outstanding shares while proportionally reducing the share price, without affecting the company’s market capitalization.

Why Indian Companies Do Stock Splits

- Boost Liquidity

- Enhance Retail Participation

- Improve Perceived Affordability

- Signal Growth Confidence

For example:

If a company announces a 1:5 stock split, one share becomes five. If the pre-split share price was ₹1,500, it becomes ₹300 post-split. Your holding value remains unchanged—but more tradable.

Stock Split Calculation: The Formula

Let’s break it down for investors calculating their holdings post-split:

New Share Price = Old Share Price ÷ Split Ratio

New Number of Shares = Old Shares × Split Ratio

Example Scenario:

- Original Holdings: 100 shares @ ₹1,000 = ₹100,000

- Split Ratio: 1:5

- New Holdings: 500 shares @ ₹200 = ₹100,000

Your investment value is intact—but now you own more units, each at a lower price.

Real Examples of Stock Splits in India

Here’s a look at Indian companies that executed notable splits:

1. Infosys (2018)

- Split: 1:5

- Pre-split Price: ₹6,900

- Post-split Price: ₹1,380

- Impact: Strong retail engagement post-split, more volume-driven movement.

2. IRCTC (2021)

- Split: 1:5

- Pre-split Price: ₹4,600

- Post-split Price: ₹920

- Impact: Huge rise in trading volumes; liquidity improved significantly.

3. Bajaj Finserv (2022)

- Split: 1:5 + 1:1 Bonus

- Impact: Massive float increase, signaling aggressive capital strategy and shareholder trust.

🔗 Reference: MoneyControl – Corporate Actions

Types of Stock Splits in India

| Type | Example Ratio | Explanation |

|---|---|---|

| Forward Split | 1:5 | 1 share becomes 5 |

| Reverse Split | 5:1 | 5 shares become 1 (rare in India) |

| Bonus Shares | 1:1, 2:1 | Additional shares issued; similar impact |

Note: While splits and bonuses both increase your shareholding, tax treatment and company intention behind them differ.

Does a Stock Split Change the Fundamentals?

Absolutely not.

Stock splits are non-fundamental corporate actions. Here’s what stays and what shifts:

What Remains Unchanged:

- Market Capitalization

- P/E Ratio (adjusted)

- Total Investment Value

- Book Value per share (adjusted)

What Changes:

- Share Price drops

- Total Shares increase

- EPS adjusts accordingly

- Liquidity generally improves

- Trading activity may spike

Split ≠ Growth. But it can be a precursor if liquidity induces momentum.

Impact of Stock Splits on Investors

For Retail Investors:

Lower share prices post-split attract new buyers who previously found the stock “expensive.”

For Traders:

More price movement. More volumes. Smaller lot sizes. That’s a trader’s dream playground.

For Institutional Players:

Splits may dilute perceived “premium,” but increased float size improves entry flexibility.

For Long-Term Holders:

No change in value—but potential increase in volume-based price action.

How to Track Upcoming Stock Splits in India

Don’t miss the opportunity. Here’s how to stay informed:

- NSE/BSE Official Websites—Corporate Announcements section

- MoneyControl & Economic Times Market Section

- Trading Platforms—Zerodha, Groww, AngelOne, Upstox

- Registrar Transfer Agents (RTA)—Like Link Intime, KFinTech

- Portfolio Tracker Apps—TickerTape, Kuvera

Stock Splits and the Derivatives Market

Yes, stock splits affect options contracts too. NSE ensures strike price and lot size are adjusted on split day.

Example:

- Pre-split: 1 Lot = 100 shares, Strike ₹1,000

- Post 1:5 Split: Lot = 500 shares, Strike ₹200

You’ll receive exchange circulars before any corporate action. Don’t assume. Confirm.

How Stock Splits Differ From Bonus Shares

| Feature | Stock Split | Bonus Issue |

|---|---|---|

| Purpose | Improve affordability | Share capital allocation |

| Fund Requirement | No funds needed | Requires capitalizing reserves |

| NAV Impact | None | NAV remains unchanged |

| Shareholder Value | Unchanged | Unchanged |

Market Update: June 2025 Snapshot

Indices:

- Nifty 50: 24,050

- Sensex: 79,200

- Nifty Bank: 54,600

Top Gainers This Week:

- Hindalco Industries—commodity boost

- Tata Motors—EV momentum

- Divi’s Labs—pharma rerating

Top Losers:

- HUL—consumption slowdown

- Tech Mahindra—muted IT spending

- BPCL—refining margins under stress

🔗 Read: [Nifty 50 Weekly Outlook]

RBI Update: Macro Trends for Equity Traders

GDP (Q1 FY26): 6.9%

Backed by infrastructure, FMCG recovery, and housing.

Inflation:

Headline CPI at 4.85%, with food prices stabilizing.

Repo Rate:

Held at 6.50%, but commentary slightly dovish. Markets anticipate rate cuts in Q4 if oil remains steady.

📌 Source: RBI.org.in

Crypto Update for Indian Investors

India’s crypto policy is in flux but leaning toward regulation over prohibition.

Key Stats (June 2025):

- Bitcoin (BTC): $64,500 – consolidation

- Ethereum (ETH): $3,400—steady after ETF tailwind

Indian Policy Landscape:

- No ban

- 30% tax + 1% TDS still active

- SEBI exploring a crypto index fund framework

🧭 For risk-tolerant investors, crypto can deliver asymmetric upside. Allocate <10%.

🔗 Related Reading: [SEBI’s Crypto View]

When Should You Buy a Stock Post-Split?

Not immediately. Avoid FOMO.

Checklist:

- Wait for post-split volume confirmation

- Check RSI—avoid overbought zones

- Validate fundamentals

- Avoid buying during corporate action volatility week

Smart Entry Tip:

Track pre-split announcements. Enter when stocks are consolidating, not rallying euphorically.

Psychological Impact of Splits

Stock splits create a “cheaper perception,” but savvy investors know better.

What Happens:

- More retail interest

- Enhanced media attention

- Psychological comfort → higher volumes

- But intrinsic value is unchanged

Don’t let the price fool you. Look at value, not optics.

Pros and Cons of Stock Splits

✅ Advantages

- Enhances liquidity

- Makes stock appear more affordable

- Increases trading activity

- Positive sentiment effect

❌ Risks

- May cause overvaluation hype

- Not supported by fundamentals

- Can trigger short-term sell-offs

- Adjustment confusion for options traders

Case Study: Titan’s Potential Future Split

Let’s assume Titan is trading at ₹3,200.

If it announces a 1:4 split:

- Post-split price = ₹800

- Retail inflow expected to increase

- Option premiums reduce = more contracts traded

- May precede inclusion in high-volume F&O watchlists

Such moves are strategic—designed to fuel growth, liquidity, and attention.

Image

Bank Nifty Weekly Options Strategy Explained (with Examples)

YouTube Video

Link Suggestions

MoneyControl Stock Splits Tracker: https://www.moneycontrol.com/stocks/marketinfo/corporateactions/home

CoinMarketCap (Crypto Prices): https://www.coinmarketcap.com

RBI Official Site (Rates & Announcements): https://www.rbi.org.in

Conclusion: Stock Splits Are Signals, Not Magic

A stock split doesn’t create wealth by itself—but it creates potential. In 2025’s dynamic Indian equity market, spotting these early is key.

So watch corporate announcements. Study split ratios. Understand liquidity impact. Use them to sharpen entries—not chase rallies.

Volatility is your friend—if you stay alert, hedge smartly, and think ahead.

Bank Nifty Weekly Options Strategy Explained (with Examples)

❓ Frequently Asked Questions (FAQs)

1. What is a stock split in the Indian stock market?

A stock split is a corporate action where a company increases its total number of shares by dividing existing shares, while proportionally decreasing the price per share. It does not change the total investment value or the company’s market capitalization.

2. How do I calculate a stock split?

Use this simple formula:

New Share Price = Old Share Price ÷ Split Ratio

New Share Quantity = Old Quantity × Split Ratio

Example: If a ₹1,000 share undergoes a 1:5 split, the new price becomes ₹200, and you hold 5x more shares.

3. Why do companies go for stock splits?

Companies split their stock to:

Improve liquidity

Make the stock more affordable

Attract retail investors

Reflect confidence in growth

It’s a strategic move to enhance market participation, not a fundamental value change.

4. Does a stock split affect my investment value?

No. Your total portfolio value remains the same immediately after the split. You own more shares at a lower price, but the combined worth is unchanged — until market forces move the price.

5. What’s the difference between a stock split and a bonus share?

| Feature | Stock Split | Bonus Share |

|---|---|---|

| Purpose | Divide existing shares | Issue new shares from reserves |

| Price Impact | Lower price per share | Usually no price drop |

| Capital Impact | No change in reserves | Capital reserves are reduced |

6. Are stock splits taxable in India?

No. Stock splits are not considered a transfer of assets, so they do not attract capital gains tax. However, when you sell the shares in the future, the original cost of acquisition is adjusted accordingly.

7. Where can I find upcoming stock split announcements in India?

You can track all corporate actions including stock splits via:

Broker platforms like Zerodha, Groww, or Upstox

8. What happens to options contracts after a stock split?

Options are adjusted by the exchange. Strike prices and lot sizes are revised so the contract value remains unchanged. Always check the NSE circular or consult your broker for exact adjustments.

9. Should I buy stocks before or after a split?

Buy only if fundamentals and timing align. A split alone isn’t a reason to buy. Wait for post-split price stability and check if volume and technical indicators confirm momentum.

10. Do all stock splits result in price increases?

Not always. While splits can boost liquidity and sentiment, price growth depends on market perception, earnings, and demand-supply dynamics. Some stocks rally post-split; others remain range-bound.

1 thought on “How to Calculate Stock Splits in the Indian Stock Market”