How to Analyze Penny Stocks in India: A Strategic Guide for Investors

Volatility is not the enemy. It’s the zipper that opens up opportunity.

Every sharp investor knows this: the real action lies where most fear to look. Penny stocks in India, long viewed as speculative bets, are actually dynamic instruments for those who know how to dissect them. But here’s the trick: analysis in this segment isn’t about P/E ratios alone. It’s about tracing the pulse of India’s unique economic terrain, recognizing manipulation traps, and aligning your radar with both global headwinds and desi catalysts.

Stay alert. Hedge smartly. And keep your portfolio nimble.

Market Snapshot (As of July 2025)

- Nifty 50: 23,650.30 (+0.7% today)

- Sensex: 78,452.67 (+0.5%)

- Top Movers:

- Up: Zomato, Adani Power, IRCTC

- Down: ONGC, BPCL, Hindalco

Oil-related trades (gas distributors, refiners): Facing margin pressure due to elevated crude prices and narrow crack spreads. Consider reducing exposure or using options for a hedge.

RBI Update:

- Repo Rate: 6.25% (Unchanged in last meeting)

- GDP Growth Forecast FY25: 6.8%

- Inflation Projection: 5.4% headline CPI

Why Penny Stocks Demand a Different Lens

Penny stocks in India are mostly those trading under Rs. 100. They occupy small-cap and micro-cap categories and often lack analyst coverage. But that doesn’t mean they lack value. It just means you have to dig deeper.

Challenges:

- Thin volumes = high volatility and susceptibility to pump & dump

- Low transparency = limited financial disclosure

- Operator activity = price manipulation

Opportunities:

- Untapped sectors (specialty chemicals, EV ancillaries, defence tech)

- Turnaround stories with cleaner balance sheets

- M&A Targets or possible delisting premiums

How to Analyze Penny Stocks: Step-by-Step Framework

1. Business Model & Scalability Check

- Is the business relevant in today’s India?

- Can it scale without heavy capital infusion?

- Look for niche moats, e.g., a micro-cap with a monopoly in railway signalling tech.

2. Promoter Integrity & Shareholding

- Track promoter shareholding trends: Rising stakes = confidence.

- Cross-check with pledged shares data.

- Read past SEBI orders or MCA filings for red flags.

3. Volume & Delivery Trends

- Check 3-month average volume.

- Watch for delivery percentage spikes (above 50% is generally healthy).

- Avoid sudden spikes in volume and price, which equal potential operator play.

4. Debt Levels & Cash Flow

- High debt with inconsistent cash flow = avoid.

- Look for improving interest coverage ratio (ICR > 2).

- Free cash flow positive companies are gold.

5. Corporate Governance & Disclosures

- Consistent quarterly updates?

- Clean audit reports with no qualifications?

- Board composition: Are there independent directors?

6. Valuation vs Peers

- Compare EV/EBITDA and price/sales with listed small caps.

- Use Screener.in or TIKR to compare peers.

Sectoral Heatmap: Where Penny Gems Hide

1. Specialty Chemicals:

India is gaining China+1 traction. Even micro-players with REACH certification or global tie-ups can shoot up.

2. Auto Ancillaries (EV-specific):

Battery pack casings, BMS components, and lightweight aluminum parts.

3. Defense Manufacturing:

Smaller firms with DRDO collaborations or offset deals.

4. Agri-Tech & Fertilizers:

Look for companies benefiting from DBT schemes and digital agri platforms.

5. Railway Infra & Logistics:

Capex boom from Indian Railways = multi-quarter tailwind.

Red Flags: Avoid These Like the Plague

- Skyrocketing price with zero earnings change

- Sudden board resignations

- The auditor exits without clarification

- Repeated equity dilution at low prices

- SEBI actions or bulk deal activity from known operators

Crypto Update: July 2025

- Bitcoin (BTC): $61,300

- Ethereum (ETH): $3,280

- India’s Crypto Regulatory Position:

- RBI still doesn’t recognize crypto as legal tender.

- Income tax on gains continues at a flat 30% with 1% TDS.

- SEBI may take over regulatory sandbox testing.

Strategic View: If your risk appetite allows, maintain a slight overweight on BTC and ETH. The halving cycle effects and institutional inflows in India (via global platforms) are supporting asymmetric upside.

Internal link suggestion: [Nifty 50 Weekly Outlook] | [SEBI’s Crypto View]

External references:

Geopolitical Risk: Strait of Hormuz Scenario

If Iran escalates tensions, up to 20% of the global oil supply could be affected. This will:

- Spike crude oil above $100

- Hit OMCs and airline stocks

- Boost inflation & dampen RBI’s dovish stance

Investor Note: Hedge oil-related exposures, increase allocation to energy trading firms, and stay updated on geopolitical headlines.

Final Checklist Before You Buy a Penny Stock

- Check BSE Announcements & Corporate Actions

- Track insider trades & block deals

- Scrutinize the balance sheet—not just profit but liquidity

- Use platforms like Screener, MoneyControl, Trendlyne for validation

- If in doubt: Wait. No trade is better than a forced one.

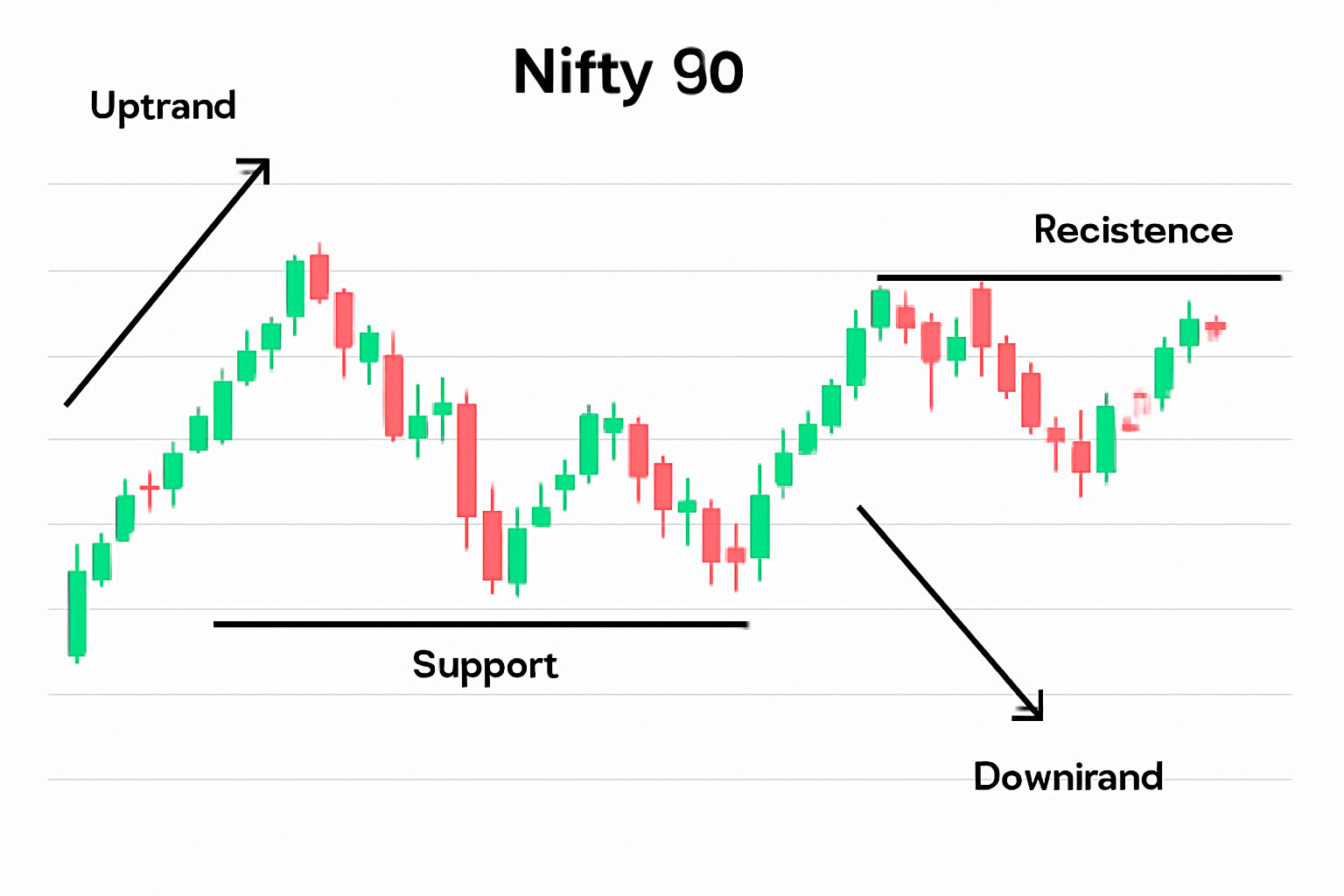

Image

YouTube Video

https://youtu.be/0ZYgPgdxmwA

Stay sharp. Stay skeptical. The penny stock game is not for the faint-hearted, but for those with a disciplined eye, the upside can be astonishing.

PAQ

PAQ GANRETE, though seemingly unfamiliar to most, is a key player in advanced technologies within the artificial intelligence (AI) landscape. While it may sound like a new concept or product, its relevance lies in the intersection of various AI techniques, particularly in the context of Generative Adversarial Networks (GANs) and Quality Assurance (QA) systems.

Understanding the Basics

To delve into the concept of PAQ GANRETE, it is essential to first comprehend what GANs and QA systems are. Generative Adversarial Networks, a breakthrough in machine learning, consist of two neural networks—the generator and the discriminator—that compete against each other to improve the overall system’s ability to create new, synthetic data resembling real data. These networks are increasingly utilized in creative AI applications, such as generating images, music, and even text.

Quality Assurance (QA), on the other hand, focuses on maintaining high standards in software development by identifying bugs and ensuring performance, security, and stability. QA systems are crucial in the tech world, especially in the development and deployment of machine learning models, as errors in the data or model can lead to disastrous outcomes.

PAQ GANRETE can be seen as a blend of these two powerful systems: it utilizes the strength of GANs for generating high-quality synthetic data while integrating a quality assurance layer to ensure that the output meets predefined standards. This hybrid system could represent an innovation aimed at making AI-generated data more reliable and applicable in real-world scenarios.

The Role of Quality in GAN-Generated Data

The quality of data generated by GANs can be inconsistent. Often, the data produced by a GAN may have artifacts, errors, or other issues that reduce its reliability for real-world applications. In fields like healthcare, finance, and autonomous vehicles, where high precision is critical, even the smallest flaw in generated data can lead to catastrophic consequences.

To address these issues, PAQ GANRETE introduces an additional layer of control by incorporating quality assurance principles directly into the GAN framework. This integration helps in two significant ways:

- Enhanced Data Integrity: By employing QA methods, PAQ GANRETE ensures that generated data adheres to a set of predefined metrics or standards. This could involve filtering out low-quality results or introducing a feedback mechanism where the GAN adjusts its output based on real-time quality assessments.

- Automated Error Detection and Correction: PAQ GANRETE could automate the process of identifying errors in the generated data, saving valuable time and resources in manual correction. This could be particularly beneficial in industries where data integrity is paramount, such as in scientific research or regulatory compliance.

Applications of PAQ GANRETE

- Synthetic Data for Training Models: PAQ GANRETE can generate synthetic data that is not only realistic but also validated for quality. This is especially important when acquiring real-world data is difficult, expensive, or privacy-sensitive, such as in medical imaging.

- Enhancing AI Creativity: In creative fields like art and design, PAQ GANRETE can ensure that the AI-generated creations are both novel and of high quality, making them suitable for commercial use.

- Reducing Human Intervention in QA: The combination of GANs and QA allows for more autonomous and efficient systems, reducing the need for extensive human oversight in data generation and testing.

Conclusion

PAQ GANRETE represents an exciting evolution in AI and data generation by ensuring that the synthetic data created through GANs meets high-quality standards. By integrating QA into the GAN framework, this system offers solutions to the issues surrounding data reliability, providing significant value to industries reliant on data-driven decision-making. This development marks a new chapter in the development of smarter, more reliable AI systems.