Explore how Indian investors can invest in Boxabl stock before IPO. Learn about Boxabl share price, company valuation & LRS route to invest.

The Strategic Landscape: Navigating Global Risks for Unconventional Alpha

The investment landscape in 2025 presents a complex chessboard for the discerning Indian investor. Global markets are caught in a cross-current of opportunity and peril. Geopolitical tensions continue to cast a long shadow, creating persistent oil supply risks that threaten to stoke inflation and disrupt economic stability. On the other end of the risk spectrum, speculative assets are seeing unprecedented attention; the potential for a massive

BTC upside captures a global appetite for high-risk, high-reward plays, acting as a barometer for market sentiment.

Back home, the narrative is equally nuanced. While opportunities exist, debates around the true value and long-term margin profiles of PSU stocks highlight the potential saturation in traditional domestic equities. This environment forces sophisticated investors to ask a critical question: where can true alpha be found? The answer, for a growing number, lies beyond the familiar confines of the Nifty 50.

In this climate, the hunt for non-correlated, high-growth assets leads to the global pre-IPO market. This is the frontier of venture-style investing—a high-stakes arena where capital is deployed into disruptive, often pre-profitability companies with the potential for exponential returns. It is within this strategic context that we must analyze Boxabl. The company is more than just a housing startup; it is a prime case study in a major theme shaping modern HNI portfolios: the deliberate allocation of capital to private, venture-stage global companies as the Indian capital markets are experiencing significant transformations.

What is Boxabl? Deconstructing the Housing Revolution

Boxabl is a Las Vegas-based construction technology company founded in 2017 by the father-son duo Paolo and Galiano Tiramani. Its stated mission is ambitious and direct: to “significantly lower the cost of homeownership for everyone” by revolutionizing how we build houses. The company argues that the $13 trillion global construction industry is inefficient and ripe for disruption, and it aims to apply modern manufacturing principles to solve this problem.

The Core Innovation: The Foldable House

Boxabl’s unique selling proposition is its patented folding technology. The company manufactures home modules, called “Casitas,” in a factory setting. These modules are fully finished—complete with a kitchen, bathroom, plumbing, and electrical systems—and then folded down into a compact, 8.5-foot-wide box.

This form factor is key. It allows the Casita to be shipped legally and affordably via standard trucks, trains, or ships, overcoming a major logistical hurdle that has historically plagued the prefabricated housing industry. Once on-site, the unit can be unfolded and assembled in just a few hours, dramatically reducing construction time and on-site labor costs.

Product Deep Dive: From Casita to Connected Communities

Boxabl’s product line has evolved from its initial proof of concept to a broader system.

- The Casita: The flagship product is a 361 sqft studio apartment (19ft x 19ft) that comes standard with a full-size kitchen, a complete bathroom, and a living space large enough for a king-size bed. It features high ceilings (9’6″), large 8ft doors and 6ft windows, and modern finishes.

- Product Line Expansion: Recognizing diverse market needs, Boxabl has expanded its offerings. It now lists larger 1-bedroom and 2-bedroom configurations, both at 722 sqft, created by connecting two modules. The company has also announced plans for stackable modules to create multi-family dwellings like townhouses and apartment buildings.

- The “BABY BOX”: To target a lower price point, Boxabl unveiled the “BABY BOX,” a compact 120 sqft living space built to RV code with an introductory price of $19,999, further showcasing its strategy to capture multiple market segments.

The Business Model: Manufacturing Meets Marketing

Boxabl operates on a hybrid business model that combines physical production with savvy digital marketing.

- Manufacturing (Brick & Mortar): The core of the business is the physical production of homes in its Las Vegas factories. This is a capital-intensive operation focused on achieving automotive-style mass production.

- Direct-to-Consumer (E-Commerce): Boxabl has masterfully used its website to build a massive pre-order waitlist. With over 190,000 non-binding reservations, this list represents a powerful marketing tool that demonstrates immense public interest, even if it doesn’t translate directly to firm sales. This waitlist has been a cornerstone of its fundraising narrative.

- Services & Compliance: A less obvious but critical part of its model involves navigating the complex web of state and local building codes, a function that positions Boxabl as a consultant in modular building solutions.

The company is led by its founders, Paolo Tiramani (CEO) and Galiano Tiramani, who drives the marketing strategy, supported by a team that includes a Director of Manufacturing and a Director of Engineering. The company’s true product may not be the house itself, but the manufacturing

system it is developing. The waitlist, while impressive, is best understood as a highly effective tool for marketing and capital raising, creating a perception of overwhelming demand that fuels investor interest. The ultimate test is converting this hype into profitable, large-scale production.

The Financial Blueprint: A Deep Dive into Boxabl’s Valuation and Performance

For any serious investor, the story must be validated by the numbers. An analysis of Boxabl’s financials reveals a classic venture-stage profile: a sky-high valuation fueled by a disruptive narrative, juxtaposed against the harsh realities of a pre-profitability, capital-intensive business.

Dedicated Section: Boxabl Company Financial Performance

Boxabl’s financial history is marked by minimal revenue, significant operating losses, and a high cash burn rate, which is typical for a company in its growth and scaling phase.

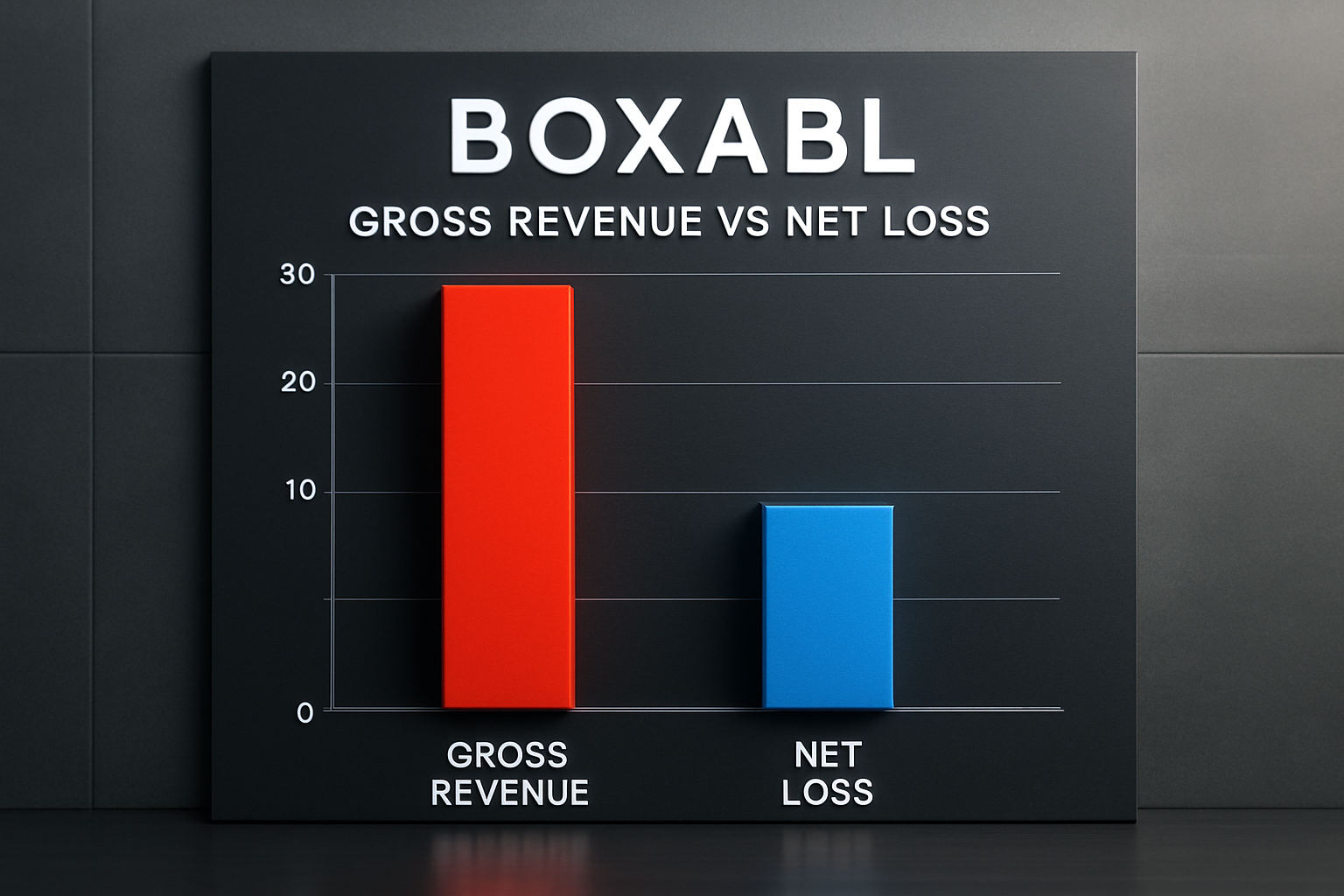

- Revenue and Profitability: The company’s revenue figures have been volatile and, to date, negligible compared to its valuation. For the first six months of 2022, Boxabl reported gross revenues of $7.6 million but suffered a net loss of $31.1 million, with the cost of goods sold exceeding revenue. More recent data from its FY 2024 10-K filing showed gross revenues of just $3.4 million. Other reports from fundraising platforms have shown periods with even lower revenue and significant net losses, such as a reported $25 million loss on $344,000 in revenue, representing a staggering 96.8% year-over-year revenue decline for that period. This financial picture underscores that the company is far from profitable.

- Cash Burn and Runway: The company’s operational costs are high. Filings and analyses point to a monthly cash burn rate ranging from $2.1 million to $3.5 million. This high burn rate gives the company a limited cash runway, estimated at various points to be between 5 and 14 months, highlighting the critical importance of its continuous fundraising efforts and the planned SPAC merger to inject new capital.

- Balance Sheet: As of a 2024 filing, Boxabl reported total assets of approximately $111 million against total liabilities of around $25 million. A significant portion of its assets was held in cash and cash equivalents ($27.5 million) and investment securities ($31.3 million), reflecting the capital it has successfully raised from investors.

Dedicated Section: Boxabl Stock Valuation

The story of Boxabl’s valuation is one of explosive growth, driven almost entirely by investor enthusiasm for its disruptive potential rather than its financial fundamentals.

- Valuation Trajectory: The company’s valuation has skyrocketed. In late 2021, it was valued at around $226 million. By August 2022, that figure had ballooned to $3 billion. In its most recent 2024 and 2025 fundraising rounds, the company has maintained a valuation of approximately

$3.5 billion.

- Funding History: Boxabl has pioneered the use of equity crowdfunding to fuel its growth. It has raised over $200 million from more than 50,000 investors across numerous rounds on platforms like StartEngine, Republic, Wefunder, and Dealmaker Securities. These campaigns have utilized Regulation A+ and Regulation CF, opening the door to both accredited and non-accredited retail investors.

- Share Price: In its latest Reg A+ offerings, the Boxabl share price has been set at $0.80 per share.

The table below consolidates key metrics, illustrating the clear disconnect between the company’s market valuation and its operational financials.

| Metric | Period 1 (H1 2022) | Period 2 (FY 2024) | Period 3 (Recent Crowdfunding Data) |

| Gross Revenue | $7.6 Million

| $3.4 Million

| $344,000

|

| Net Loss | ($31.1 Million) | ($39.5 Million)

| ($25.1 Million)

|

| Total Assets | $74.3 Million

| $111.2 Million

| $107.5 Million

|

| Total Liabilities | $6.7 Million

| $25.3 Million

| $25.2 Million

|

| Cash on Hand | $56.8 Million

| $27.5 Million

| $18.6 Million

|

| Valuation | ~$3.0 Billion

| ~$3.5 Billion

| ~$3.5 Billion

|

| Price Per Share | N/A | $0.80

| $0.80

|

This data makes it clear that an investment in Boxabl is not a bet on its current balance sheet. It is a venture capital-style bet on its story, its technology, and its ability to capture a slice of the enormous global housing market. The primary risk is not market fluctuation, but execution failure—the company’s ability to bridge the vast gap between its compelling narrative and achieving profitable, scaled production.

The Path to Public Markets: Is a Boxabl IPO Imminent?

For pre-IPO investors, the single most important catalyst is a public listing, which provides the liquidity needed to realize returns. Boxabl has made its intentions clear, but the path forward is conditional and carries significant uncertainty.

Dedicated Section: When will Boxabl go public? The SPAC Merger

Instead of a traditional IPO, Boxabl is pursuing a merger with a Special Purpose Acquisition Company (SPAC). This route is often faster and allows a company to go public with a compelling growth story, even without a history of profitability.

On June 9, 2025, Boxabl announced it had entered into a non-binding letter of intent (LOI) to merge with a NASDAQ-listed SPAC. The terms outlined in the LOI state that the SPAC holds $80 million in its trust (though this is subject to redemptions by the SPAC’s shareholders) and that existing Boxabl equity holders would roll 100% of their stake into the newly combined public company.

However, investors must approach this news with extreme caution. The LOI is explicitly non-binding. The deal’s completion is contingent upon several factors, including the completion of due diligence, the negotiation of a definitive agreement, and approvals from both companies’ boards and shareholders. The company’s own press release states there can be “no assurance that the Proposed Definitive Agreement will be entered into or that the Proposed Transaction will be consummated”.

Adding to the uncertainty, the SPAC partner has not been publicly named, often referred to simply as “TBA” (To Be Announced) in market reports. This lack of a named partner is a major red flag and indicates that the deal is still in a very preliminary and conditional stage.

Dedicated Section: Boxabl Stock Symbol NASDAQ

In a preparatory move for its public debut, Boxabl has reserved the stock ticker symbol ‘BXBL’ on the NASDAQ exchange. While this signals serious intent, it is crucial to understand that reserving a ticker does not guarantee a listing, nor does it mean Boxabl has met NASDAQ’s stringent financial and governance requirements. The reservation is reportedly valid for 24 months, suggesting a potential timeline of by mid-2027 for the company’s public market ambitions.

Dedicated Section: Boxabl Stock Price Prediction 2025

Predicting a specific stock price for a pre-IPO company is speculative at best. Instead, a strategic analysis focuses on the factors that will drive its valuation post-merger.

- The Bull Case: A successful and timely closing of the SPAC merger would be the primary catalyst. If Boxabl can then demonstrate a rapid ramp-up in production, convert a meaningful portion of its 190,000+ waitlist into firm, revenue-generating orders, and benefit from favorable regulatory tailwinds for Accessory Dwelling Units (ADUs) in key markets like California, investor sentiment could be extremely positive.

- The Bear Case: The risks are substantial. The SPAC deal could collapse, leaving the company scrambling for capital given its high cash burn rate. Continued production delays, an inability to navigate state-by-state building codes, or further negative publicity could severely damage investor confidence and the company’s valuation.

The choice of a SPAC is a pragmatic one for a company like Boxabl, which needs capital and speed to market. However, until a definitive agreement with a named, reputable SPAC partner is announced, the path to a public listing remains a significant, unresolved risk for investors.

The Indian Investor’s Playbook: How to Buy Boxabl Stock Pre-IPO

Investing in a private US company from India was once the exclusive domain of institutional players. Today, thanks to regulatory frameworks and new technology platforms, it is possible for individual Indian investors. However, the process requires careful navigation of both US and Indian regulations.

Dedicated Section: The Two Gates: Boxabl Stock for Accredited vs. Retail Investors

The U.S. Securities and Exchange Commission (SEC) divides investors into two main categories, and this distinction governs your investment options.

- Accredited Investors: These are individuals who meet specific wealth thresholds: an annual income of over $200,000 ($300,000 with a spouse) for the last two years, or a net worth of over $1 million (excluding primary residence). They are considered “sophisticated” and have access to a wider range of private investments.

- Non-Accredited (Retail) Investors: This category includes everyone else. The SEC provides specific regulations to allow them to participate in certain private offerings, but with limits to protect them from excessive risk.

Dedicated Section: Where to Invest in Boxabl Private Shares

There are two primary avenues to acquire Boxabl shares before its IPO.

- Equity Crowdfunding (Direct Offerings): This is the main route Boxabl has used to raise capital from the public, including retail investors. These offerings operate under SEC regulations like Regulation A+ (Reg A+) and Regulation Crowdfunding (Reg CF), which permit non-accredited investors to participate, though their investment amount may be capped (e.g., at 10% of annual income or net worth). Boxabl has run successful campaigns on platforms such as

StartEngine, Dealmaker, Wefunder, and Republic. These offerings are not perpetually open; investors must check the platforms for active campaigns.

- Secondary Markets (Accredited Investors Only): This is a marketplace where early investors and employees can sell their private company shares to other qualified buyers. These platforms are exclusively for accredited investors. Prominent secondary marketplaces include Forge Global, Hiive, and the Nasdaq Private Market. This route offers potential access to shares when direct offerings are closed, but it is a more complex transaction environment.

Dedicated Section: The Regulatory Bridge: Investing from India via RBI’s LRS

For an Indian resident, the key to investing in Boxabl is the Reserve Bank of India’s Liberalised Remittance Scheme (LRS).

The LRS allows a resident Indian to send up to USD 250,000 abroad per financial year (April-March) for permissible capital account transactions, which explicitly includes purchasing overseas shares and securities.

The step-by-step process is as follows:

- Select a Platform: Open an account with a fintech platform that facilitates US stock investing for Indians. Examples include Winvesta, INDmoney, or Vested. These platforms have partnerships with US brokers and streamline the LRS process.

- Complete KYC: You will need to complete a Know Your Customer (KYC) process. A PAN card is mandatory for all LRS transactions. You will also likely need to provide your Aadhaar card.

- Initiate LRS Transfer: To fund your account, you must initiate an LRS transfer from your Indian bank account. This involves filling out Form A2 (Application for Remittance Abroad) and declaring the correct purpose code for the transaction, which for equity investment is typically S0001.

- Fund Conversion & Remittance: Your bank will then convert your Indian Rupees (INR) to US Dollars (USD) and transfer the funds to your overseas brokerage account. You can then use these funds to invest on the chosen platform.

Dedicated Section: Tax Implications for Indian Investors

Investing in US assets comes with tax obligations in both countries. The India-US Double Taxation Avoidance Agreement (DTAA) is a critical treaty that prevents your income from being taxed twice.

- TCS (Tax Collected at Source): When you remit funds under LRS, a TCS of 20% is levied on amounts exceeding ₹7 lakh in a financial year. This is not a final tax; you can claim the amount paid as a credit against your tax liability or as a refund when you file your Income Tax Return (ITR) in India.

- Capital Gains Tax (in India):

- Short-Term Capital Gains (STCG): If you sell your Boxabl shares after holding them for less than 24 months, the profit is considered STCG. It is added to your total income and taxed according to your applicable income tax slab.

- Long-Term Capital Gains (LTCG): If you hold the shares for more than 24 months, the profit is LTCG and is taxed at a rate of 20% (plus applicable cess) with the benefit of indexation.

- Short-Term Capital Gains (STCG): If you sell your Boxabl shares after holding them for less than 24 months, the profit is considered STCG. It is added to your total income and taxed according to your applicable income tax slab.

- Dividend Tax: If Boxabl were to issue dividends, a flat tax of 25% would be withheld in the US. Under the DTAA, you can claim a credit for this tax paid in the US against your income tax liability in India.

The following checklist simplifies the compliance process for Indian investors.

| Step | Requirement | Key Details & Source Reference |

| 1. Eligibility Check | Must be a “Resident of India” as per FEMA. | LRS is not available to NRIs, corporations, or trusts.

|

| 2. PAN Card | A valid PAN is mandatory for all LRS transactions. | This applies even to minors remitting funds.

|

| 3. Choose Platform | Select a platform that legally facilitates overseas investments. | Platforms like Winvesta provide a Multi-Currency Account for legal LRS transfers. Avoid using credit cards for such investments.

|

| 4. Bank Formalities | Fill and submit Form A2 with the correct purpose code. | Purpose code for equity investment is typically S0001. Income proof may be required for large remittances.

|

| 5. LRS Limit Check | Total remittances must not exceed USD 250,000 per person per financial year. | This limit can be clubbed with family members for certain transactions.

|

| 6. TCS Awareness | Be aware of the 20% Tax Collected at Source on remittances above ₹7 lakh. | This amount is claimable as a credit or refund when filing your ITR in India.

|

While Reg A+ and CF offerings technically “democratize” access to venture capital, the inherent nature of this investment—highly illiquid, speculative, and pre-profit—carries venture-level risk. For Indian investors, the complexity of LRS and cross-border taxation, combined with the lock-in risk if the IPO fails, makes this opportunity far more suitable for sophisticated High-Net-Worth Individuals (HNIs) who can afford a total loss on a small portion of their diversified portfolio.

The Competitive Arena: Boxabl vs. Traditional Housing and Modular Peers

Boxabl is not operating in a vacuum. It aims to disrupt the massive traditional construction sector while simultaneously competing with a growing field of well-funded modular and prefabricated housing companies.

Dedicated Section: Boxabl vs. Traditional Housing Stock

Boxabl’s entire disruption thesis is built on its advantages over conventional, on-site construction.

- Speed and Efficiency: Boxabl promises to erect a home in a single day, compared to the 7-12 months required for a standard home. This is achieved by moving 90% of the construction process into a controlled factory environment, eliminating weather delays and streamlining labor.

- Cost Reduction: By leveraging assembly-line principles, bulk material purchasing, and reduced reliance on expensive, skilled on-site labor (like licensed electricians for repetitive tasks), Boxabl aims to dramatically lower the end cost of housing.

- Quality and Sustainability: Factory production allows for higher precision and quality control. The designs are also more energy-efficient and produce significantly less construction waste compared to traditional building methods.

From an investment perspective, a successful modular player like Boxabl could reshape real estate dynamics. By rapidly increasing housing supply, particularly in the Accessory Dwelling Unit (ADU) market, it could help stabilize soaring property prices and create new investment opportunities in prefab housing developments. This makes it a potential threat to the business models of traditional homebuilders and developers.

Dedicated Section: Sizing Up the Competition

The modular housing space is becoming increasingly crowded and competitive. While Boxabl has captured the public’s imagination, it faces formidable rivals.

- Mighty Buildings: A key competitor that focuses on 3D-printing technology for construction. It has raised over $150 million and targets developers with whole communities of prefab homes.

- Veev: A tech-enabled homebuilder that raised a staggering $600 million before being acquired. It focused on a fully integrated, technology-driven approach to building.

- Other Notable Players: The field includes companies like Blokable (multifamily focus), Connect Homes (patented steel-frame system), Plant Prefab, and Factory OS, each with its own technology, market niche, and significant funding.

What sets Boxabl apart in this crowded field is not just its folding technology, but its aggressive, direct-to-consumer marketing and brand-building prowess. While many competitors focus on B2B relationships with developers, Boxabl has created a viral, consumer-facing brand fueled by social media, a massive public waitlist, and the viral story of Elon Musk reportedly owning a unit. This has allowed it to build a “cult-like” following and raise enormous capital directly from the public, giving it a unique brand momentum that is one of its most valuable, albeit intangible, assets.

Strategic Conclusion: The Boxabl Investment Opportunity – A High-Stakes Bet on Revolution

Evaluating the Boxabl investment opportunity requires a clear-eyed assessment of its monumental potential against its equally significant risks. This is not a traditional investment; it is a venture capital play available to the public, and it should be treated as such.

The Bull Case rests on a powerful narrative of disruption. Boxabl is targeting a multi-trillion-dollar global market with a patented, innovative product that addresses a fundamental human need: affordable housing. The immense public interest, evidenced by a 190,000+ reservation list and over 50,000 investors, demonstrates a product-market fit that is the envy of many startups. The planned SPAC merger provides a clear, albeit conditional, path to public market liquidity, which could unlock significant value for early investors.

The Bear Case, however, is grounded in financial reality and execution risk. The company’s ~$3.5 billion valuation is profoundly disconnected from its current financials, which show minimal revenue and substantial, ongoing losses. The high cash burn rate makes the company heavily reliant on continuous fundraising and the successful closure of the SPAC deal. The merger itself remains non-binding with an unnamed partner, a major source of uncertainty. Furthermore, Boxabl faces intense competition and the monumental challenge of scaling production profitably while navigating a patchwork of state-level building regulations. This is a classic case of

the risks in pre-IPO ventures [https://indianstocksmarket.com/altm-stock/].

For the sophisticated Indian investor, Boxabl represents a high-risk, high-reward allocation. It is a binary bet on the management team’s ability to execute. Success hinges on two critical milestones: first, closing the SPAC merger to secure capital and a public listing; and second, translating viral hype and a massive waitlist into a profitable, scaled manufacturing operation.

An investment in Boxabl should only be considered by those with a high-risk tolerance and a long-term horizon, representing a small fraction of a well-diversified portfolio. It is not an investment for the risk-averse or those who may require liquidity in the near term. This is a bet on a revolution—and revolutions are rarely smooth or certain. Investors must be prepared for the possibility of a total loss, balanced against the potential for an extraordinary return if Boxabl truly manages to put the world’s housing needs in a box. The speculative nature of new asset classes like this requires careful consideration, much like when evaluating the speculative nature of new asset classes [https://indianstocksmarket.com/m-coin-price/].

YouTube Video Suggestion:

Find a relevant video for this topic, such as a recent Boxabl factory tour from their official YouTube channel or a detailed interview with Galiano Tiramani. A video like “INSIDE LOOK – Assembly Line Review” or a comprehensive factory tour would provide excellent visual context for the manufacturing process discussed in this article. https://www.youtube.com/watch?v=xH5WQaFq9o0

Links:

For due diligence, investors can review all public filings on the (https://www.sec.gov/edgar/browse/?CIK=1816937). The broader modular construction trend and the mechanics of SPACs are frequently covered by major financial news outlets, and

(https://www.bloomberg.com), this sector continues to attract significant investor attention.

Detailed FAQ Section

Is Boxabl a publicly traded company? No, Boxabl is a privately held company as of late 2025. It is not listed on any public stock exchange like the NYSE or NASDAQ. The company has announced its intent to go public via a SPAC merger, but this transaction is not yet complete.

How to buy Boxabl stock pre-IPO? There are two main ways. First, through direct equity crowdfunding offerings (under Reg A+ or Reg CF) on platforms like StartEngine or Dealmaker when a campaign is active. This is open to both retail and accredited investors. Second, accredited investors can use secondary marketplaces like Forge Global or Hiive to buy shares from existing shareholders.

What is the Boxabl share price? As a private company, Boxabl does not have a public stock price that fluctuates daily. In its most recent equity crowdfunding rounds in 2024-2025, the price per share was set at $0.80. On secondary markets, the price is determined by buy-and-sell offers between private parties.

When will Boxabl go public? Boxabl announced a non-binding letter of intent to merge with a NASDAQ-listed SPAC on June 9, 2025. However, there is no definitive timeline for the merger’s completion, as it is subject to due diligence, negotiation, and shareholder approvals. The company has reserved the NASDAQ ticker ‘BXBL’, which is valid for 24 months, suggesting a target window of by mid-2027 for a public listing.

What is the current Boxabl stock valuation? In its most recent fundraising rounds, Boxabl has been valued at approximately $3.5 billion. This valuation has grown dramatically from just over $200 million in late 2021, reflecting strong investor interest in its growth story despite the company not being profitable.

Is Boxabl a good investment opportunity? Boxabl is a high-risk, high-reward venture capital-style investment. The potential upside is massive if it can successfully disrupt the housing industry. However, the risks are equally large, including a valuation disconnected from current financials, ongoing losses, high cash burn, and significant execution hurdles in scaling production and closing its SPAC deal. It is suitable only for investors with a high-risk tolerance and as a small part of a diversified portfolio.

How can an Indian citizen invest in Boxabl? An Indian resident can invest by using the RBI’s Liberalised Remittance Scheme (LRS), which allows remitting up to USD 250,000 per year for overseas investments. The process involves opening an account with a platform that facilitates US investments, completing KYC with a mandatory PAN card, and transferring funds from an Indian bank using Form A2. Investors must be aware of TCS and capital gains tax rules.

What is the potential Boxabl stock symbol for NASDAQ? Boxabl has officially reserved the ticker symbol ‘BXBL’ with the NASDAQ stock exchange in anticipation of its future public listing.

How is Boxabl’s company financial performance? Boxabl’s financial performance is characteristic of a pre-profitability growth company. It has generated minimal revenue (e.g., $3.4 million in FY 2024) while incurring significant net losses (e.g., over $30 million in some periods) due to high R&D, manufacturing setup, and marketing costs. The company is burning through cash and relies on continuous fundraising to finance its operations.

Is Boxabl stock available for retail investors? Yes. Through its use of Regulation A+ and Regulation Crowdfunding offerings on platforms like StartEngine, Boxabl has made its shares available to non-accredited (retail) investors. However, these investors may face limits on the amount they can invest based on their income or net worth.

How does Boxabl stock compare to traditional housing stocks? Investing in Boxabl is fundamentally different from investing in established, traditional housing stocks (e.g., large homebuilders). Traditional housing stocks are bets on the cyclical real estate market and offer dividends and stable, predictable earnings. Boxabl stock is a venture-style bet on technological disruption. It offers no dividends and has no profits, but it has the potential for exponential growth if its technology and business model succeed, a risk-reward profile that is much higher than that of its traditional peers. You can learn more about

analyzing other unlisted tech companies [https://indianstocksmarket.com/mitbbs-stock/].

Somebody essentially help to make significantly articles Id state This is the first time I frequented your web page and up to now I surprised with the research you made to make this actual post incredible Fantastic job

Hi my loved one I wish to say that this post is amazing nice written and include approximately all vital infos Id like to peer more posts like this

you are in reality a just right webmaster The site loading velocity is incredible It seems that you are doing any unique trick In addition The contents are masterwork you have performed a wonderful task on this topic

Hello Neat post Theres an issue together with your site in internet explorer would check this IE still is the marketplace chief and a large element of other folks will leave out your magnificent writing due to this problem

I do not even know how I ended up here but I thought this post was great I do not know who you are but certainly youre going to a famous blogger if you are not already Cheers

Thank you for the auspicious writeup It in fact was a amusement account it Look advanced to more added agreeable from you By the way how could we communicate