Best Free Stock Screener for Intraday Trading in India (2025)

Discover the best free stock screeners for intraday trading in India (2025). Stay sharp with powerful tools, real-time filters, and market insights.

Volatility Isn’t the Enemy—It’s the Opportunity Zipper

The markets in 2025 are not for the faint-hearted. But for the well-equipped trader? They’re an open playground.

You see, volatility doesn’t kill a smart trader; it breathes life into their intraday game. The trick isn’t to avoid the chaos, but to read it faster than others. With the right screeners in your arsenal, you’re not watching stocks move—you’re anticipating them.

Every sharp move, every price shock, every liquidity burst—that’s your signal, if you’re watching with the right lens.

So let’s dive into what matters most for Indian day traders this year: the best free stock screeners and how to use them in the current market climate. But before that, let’s set the scene.

Market Pulse: June 2025

📊 Nifty and Sensex at Crossroads

- Nifty 50: Hovering around 23,680, after a minor retracement from its recent high of 24,000. Bullish structure remains intact, but sellers are probing.

- Sensex: Trading near 78,250, showing resilience with support from private banks and IT majors.

🚀 Top Movers Today

Big Gainers:

- IRFC: +6.4%—strong momentum driven by government infrastructure push.

- Zomato: +5.8%—breakout above ₹200 with record volume.

- Tata Power: +4.9%—bullish sentiment around green energy projects.

Major Losers:

- ONGC: –3.7%—pressure from global crude fluctuations and policy uncertainty.

- Maruti: –2.5%—yen volatility hits margin forecasts.

🏛️ RBI Outlook: What’s Driving Monetary Policy?

The Reserve Bank of India remains in inflation-watch mode. The June policy maintained the repo rate at 6.50%, citing stubborn inflation and uncertain global flows.

- GDP Growth Estimate: 6.8% for FY26

- CPI Inflation: 5.2% YoY

- Forex Reserves: Comfortable buffer despite a strong dollar cycle

- Bond Yields: 10Y at 7.1%—suggesting no immediate easing

“Monetary conditions are aligned with our objective of achieving durable disinflation without growth disruption.”

— RBI Governor, June 2025

Source: RBI Official Site

What This Means for Intraday Traders:

- Expect rate-sensitive sectors (NBFCs, real estate) to stay volatile.

- PSU banks and exporters might outperform on capital flow optimism.

- Defensive sectors could see a comeback if CPI trends higher.

⚔️ Geopolitical Radar: Strait of Hormuz Heats Up

One tension to watch closely is the Strait of Hormuz—through which 20% of global oil flows. Recent naval skirmishes between Iran and Western alliances are triggering oil spike risk.

This could send ripples through:

- Oil marketing companies (BPCL, IOCL): Margin compression fears

- Shipping and logistics stocks: Price gouge benefit potential

- Auto stocks could correct if oil spikes 10%+

🛡️ Playbook Tip: Hedge exposed sectors. Watch for short-term alpha in supply chain logistics, Indian LNG operators, and specialty energy exporters.

🌐 Crypto Market in India (2025): Legitimizing, Slowly

BTC & ETH—Resurgence in Motion

- Bitcoin (BTC): ~$66,800—finding steady base post-halving

- Ethereum (ETH): ~$3,380—strong institutional interest post-ETF approvals

India’s Position

India’s regulators continue walking a tightrope:

- SEBI: Exploring regulated digital asset ETFs

- CBDC (Digital Rupee): Gaining usage in interbank settlements

- Taxation: Flat 30% gains tax, 1% TDS still in place, but clearer compliance norms

For deeper insights, see our dedicated post: [SEBI’s Crypto View]

🔍 Best Free Stock Screeners for Intraday Trading in India (2025)

Why You Need a Screener for Day Trading

Intraday trading thrives on:

- Momentum

- Liquidity

- Timely breakouts and reversals

A good screener slices through the 1,500+ stocks and serves you only what matters—now.

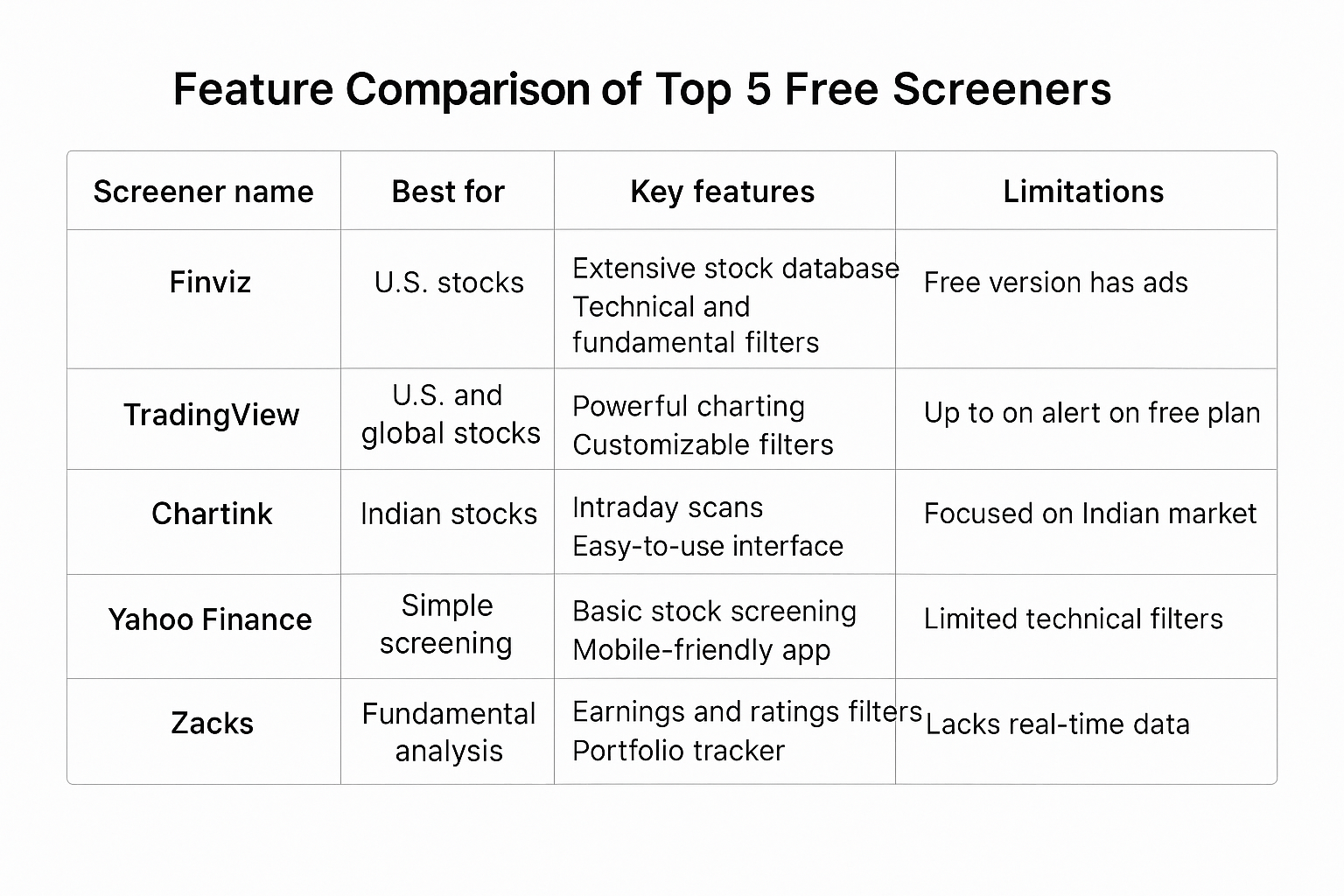

Here are the top 5 free screeners every Indian intraday trader should master:

🧰 1. Chartink—India’s Favorite Screener for Live Setups

URL: chartink.com

Chartink is every intraday trader’s Swiss Army knife. Though the real-time feed is delayed in the free version (~5–15 mins), its customizable technical filters are unmatched.

Why it stands out:

- Real-time screening (premium gives 1-min feeds)

- Build your own scans using conditions like

- “Price above 5-day SMA and crossing yesterday’s high”

- “Volume surge above 30% in last 15 min”

Use it for:

- Breakout scanners

- VWAP reversals

- Opening range momentum

Limitations:

- Not integrated with any trading platform

- Real-time scan refresh requires paid plan (~₹780/month)

📊 2. TradingView India—The Charting Powerhouse with Screeners

URL: in.tradingview.com

TradingView’s free version gives access to over 100 screening filters, from momentum, volume, and volatility to custom scripts (Pine editor).

Why it stands out:

- Screener built right into the charting tool

- Use public strategies: “MACD crossover on 5-min,” “RSI bounce at 40.”

- Custom alerts for stock breakouts

Use it for:

- Multi-timeframe analysis

- Chart + screener flow (watch + act)

- Global markets and crypto too

Limitations:

- Indian market live data needs NSE feed subscription

- Limited alerts and indicators on free plan

📈 3. NSE India Screener—Raw Data with Actionable Signals

URL: nseindia.com

Under the surface, NSE’s website has an underrated treasure chest of data.

Key features:

- Pre-market gainer/loser list

- FII/DII flows

- High delivery stocks

- Price shockers

Use it for:

- Morning trade prep (8:45–9:15 AM)

- Volatility bursts

- Filtering F&O ban stocks

Limitations:

- Not customizable

- Needs manual work—great for disciplined traders

🔎 4. Screener.in—Fundamental Screener for Swing-to-Day Ideas

URL: screener.in

While not built for intraday, Screener.in can be hacked to filter stocks that:

- Have rising volumes over recent sessions

- Strong fundamentals + recent price action

Best use case:

- BTST setups

- Event-driven trades (results, M&A, dividends)

Limitations:

- No charts or indicators

- Delayed price data

💼 5. Fyers One Terminal—Desktop Power for Free

URL: fyers.in

Fyers offers a full-featured trading terminal (like Zerodha Pi, but free).

What you get:

- Real-time screener

- Heatmaps

- Market depth and order flow

- Watchlists, alerts, news panel

Perfect for:

- Traders who want screen + order placement + depth view

Limitations:

- Must open a Fyers account

- Steep learning curve for beginners

⚙️ Top Intraday Screener Strategies for 2025

⏰ Opening Range Breakout (ORB)

- 5–15 minute candles

- Break above the initial high with volume

- Screener: Chartink + TradingView

🎯 VWAP Bounce + RSI Confluence

- Price above VWAP, RSI bounces off 45–50

- Mid-day scalp candidates

- Screener: TradingView + manual chart filtering

🔁 Mean Reversion

- Stocks down >3% intraday but stabilizing near support

- Diverging RSI, MACD crossover

- Screener: Chartink custom scan + TradingView alerts

🛒 BTST Screener

- Price breaking out with high delivery %

- Earnings or news-backed

- Screener: NSE India + Screener.in combo

📎 Internal Link Suggestions

- Explore our [Nifty 50 Weekly Outlook] for tactical index levels.

- Want deeper regulatory context? Read [SEBI’s Crypto View].

📸 Visual Assets to Include

best free stock

🎥 YouTube Video

- “5 Best Free Intraday Stock Screeners for Indian Markets (2025)”

➝ Include live scans, walkthroughs, use cases

🧠 Closing Thoughts: Be the First to See the Move

The difference between chasing and leading? Preparation.

In 2025’s fast-paced trading environment, a free stock screener can be your first edge—if you use it right. Build your routines. Trust your setups. And above all, let data—not emotion—guide your trades.

📌 Bookmark this post. Revisit it before every Monday opening. And if you’re serious about leveling up, don’t just use a screener—master one.

Let me know if you’d like this article as a formatted blog upload, PDF, or even turned into a script for a YouTube video or newsletter feature.

Read More_ Top 10 Chinese Companies Listed in Indian Stock Market