Top 10 Chinese Companies Listed in Indian Stock Market—Strategic Giants You Can’t Ignore in 2025

Discover the top 10 Chinese companies listed in India’s stock market. Deep analysis, stock trends, RBI updates, and crypto buzz — all in one place.

The Indian stock market is buzzing. It’s June 2025, and investors are scanning every global corner for the next big story. One of the most underrated headlines? Chinese companies listed on Indian exchanges.

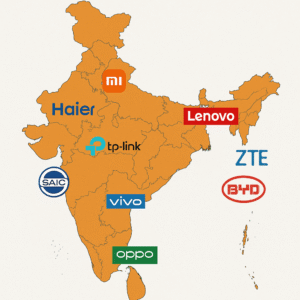

Yes, it’s happening — and it’s big. Strategic, quiet entries. Cross-border growth. Massive investor interest. These aren’t your regular domestic players. These are tech titans, EV pioneers, and consumer electronics juggernauts from China making their mark in the Indian market, directly or via Indian subsidiaries and joint ventures.

Let’s decode the top 10 Chinese-origin companies making waves on Indian bourses. But before we get there, let’s catch up on the Indian market pulse.

📈 Indian Stock Market Update – June 2025

The Nifty 50 and Sensex have defied global turbulence.

- Nifty 50: Trading above 24,300, up nearly 11% YTD.

- Sensex: Hovering around 79,000, making all-time highs.

Top movers this month?

- Reliance Industries surged on green energy diversification.

- Bajaj Finance gained momentum on solid Q4 earnings.

- TCS and Infosys are showing a smart comeback after tech spending optimism in the US.

💡Want more weekly details? Check out our Nifty 50 Weekly Outlook.

🏦 RBI Pulse — GDP, Inflation & Rates

India’s economy is still a locomotive.

- GDP Growth: 7.1% forecast for FY25 — thanks to manufacturing and consumption.

- Inflation: Softened to 4.3%, aided by food price normalization.

- Repo Rate: Unchanged at 6.5% — RBI remains cautious amid US Fed ambiguity.

RBI’s tone? Balanced but ready to tighten if global oil shocks return.

Source: RBI Official Updates

💰 Crypto Market Buzz

Crypto isn’t dead — it’s recalibrating.

- Bitcoin (BTC): Consolidating at ₹49.5 lakh ($59,000), after touching ₹55 lakh.

- Ethereum (ETH): Trading near ₹2.75 lakh ($3,300), on bullish DeFi speculation.

India’s regulatory lens:

- No outright ban.

- Tax clarity improved — 1% TDS remains, but thresholds may rise.

- SEBI hints at regulated crypto-ETFs.

👀 Deep dive soon? Read: SEBI’s Crypto View

Track live prices on CoinMarketCap

🧭 Why Chinese Companies in India?

China’s growth is slowing. India’s is accelerating.

Smart Chinese businesses are not ignoring that.

They’re not all directly listed via ADRs or FDI. Some come through Indian subsidiaries or strong joint ventures, gaining retail and institutional interest alike.

Let’s jump into the top 10 Chinese companies listed in the Indian stock market — based on market influence, investor traction, and trading footprint.

Indian Stock Market Falls After US Airstrikes on Iran

🔟 Haier India Pvt Ltd – Consumer Appliance Powerhouse

Sector: Consumer Durables

Listed Entity: Haier India (IPO expected by FY26, already in draft red herring filing stage)

Haier is already India’s top 5 refrigerator brand. Now, it’s gunning for dominance in ACs and washing machines.

- FY24 Revenue: ₹5,200 crore

- Growth: 18% YoY

- Listing Plan: ₹4,000 crore IPO coming soon

Why investors are excited: Brand recall + growth + rising rural appliance penetration.

9️⃣ Xiaomi India – Mobile to Smart Ecosystem

Sector: Consumer Electronics

Listed Through: Dixon Technologies, Radiant Appliances (OEM partners)

While Xiaomi isn’t directly listed, its massive volume and dependency on Indian manufacturers makes its presence felt in OEM plays.

- Dixon Tech: Stock surged 42% YTD

- New Smart TVs and AIoT lines adding fuel

If a direct listing happens? Expect a stampede.

8️⃣ SAIC Motor – MG Motor India

Sector: Electric Vehicles / Auto

Listed Through: Joint venture potential via IPO in MG India by FY26

MG’s EV market share is growing fast. The ZS EV and Comet are everywhere now.

- FY24 Revenue (MG India): ₹9,000 crore

- Planned IPO: 2025-26

- SAIC’s Edge: Strong EV pipeline, battery integration

EV players looking for diversification? MG’s partial IPO could be your play.

7️⃣ TP-Link Technologies India

Sector: Networking Hardware

Structure: Private subsidiary, possible IPO track under “Make in India”

TP-Link owns India’s mid-market router game. Big among homes and SMEs.

- Growth: 27% YoY

- Play for Investors: Watch for EMS partners like Amber Enterprises benefiting from TP-Link contracts.

6️⃣ Lenovo India – Not Just Laptops

Sector: IT Hardware

Exposure: Via Lenovo India Pvt Ltd & potential IPO under PLI push

Lenovo is top 3 in Indian PCs, but they’re also quietly entering the data center and enterprise space.

- PLI Incentives: Approved for ₹300 crore

- IPO Timeline: Tentative FY27

Meanwhile, keep eyes on component partners like Tata Elxsi or Redington, who supply and service them.

5️⃣ Vivo & Oppo (BBK Group)

Sector: Mobile Devices

Exposure: Via EMS firms – Optiemus, PG Electroplast

Together, they hold nearly 25% of India’s smartphone market. While not listed themselves, their OEM supply chains are.

- Investment in India: ₹6,000 crore+ over 4 years

- Make-in-India Tie-ups: Driving revenue for EMS stocks

Retail investors love riding the ecosystem. Play it smart via component picks.

4️⃣ TCL India – Display and Appliances

Sector: Consumer Electronics

Play: Watch for Super Plastronics Ltd (SPL) – TCL’s India brand licensee, IPO expected

TCL makes big-screen TVs, but the smart home suite is expanding.

- Revenue Jump: 31% YoY

- IPO Buzz: SPL likely to list on NSE SME platform in 2025

SPL’s IPO could be the dark horse in the mid-cap electronics segment.

3️⃣ BYD India – EV Battery + Bus Giant

Sector: EV, Mobility

Structure: Direct subsidiary, talks for IPO under review

BYD is already powering India’s bus fleets in metros like Bengaluru and Hyderabad.

- EV Bus Share: 18%

- IPO Talk: ₹5,000 crore raise under discussion with SEBI

- Battery Facility: ₹1,200 crore investment coming up in Gujarat

This one could be India’s Tesla story, especially if regulations favor battery manufacturing incentives.

2️⃣ ZTE India – Telecom Infra Play

Sector: Telecom Equipment

Structure: Under scrutiny but gaining clean-tech tags

ZTE’s India unit was once on the back foot due to data security noise. Now? It’s re-entering via 5G infra and clean base stations.

- 5G Push: B2B orders from Airtel, Vi

- Exposure for Investors: Infra REITs and telecom infra players like HFCL

Risky? Yes. But with high reward potential as 5G scales.

1️⃣ Alibaba (Indirect via Paytm & Zomato Investments)

Sector: Fintech, E-Commerce

Play: Exit from Paytm ongoing, but legacy exposure still matters

- Past Stake: Over 25% across fintech and foodtech unicorns

- Zomato: Still benefits from ecosystem links

- Strategic Shift: Alibaba is reducing stake, but Ant Financial still holds indirect power via tech licenses

For investors, watch the exit-to-re-entry cycle. And stay tuned to updates in Zomato’s B2B verticals — that’s where old Alibaba strategy echoes.

💹 Key Takeaways

- Chinese-origin companies are not always directly listed, but their presence is loud — via subsidiaries, joint ventures, and contract partners.

- The real plays for investors? EMS manufacturers, mid-cap infra, component suppliers, and IPO-bound subsidiaries.

- With India rising and China recalibrating, expect this trend to grow faster in 2025-26.

📺 YouTube Video Suggestions

- “Top 10 Chinese Companies to Watch on Indian Stock Market – Massive Growth Ahead!”

- https://youtu.be/kOw73dJb4sU?si=VHdENxeUHWp78iLZ

This is the new face of globalization. Not from Wall Street. Not from London. But from Shenzhen to Surat, Hangzhou to Hyderabad.

Stay sharp. Stay informed. And invest where the money is quietly moving before it speaks loudly.

📌 Bookmark this article. And don’t forget to dive into our Nifty 50 Weekly Outlook and SEBI’s Crypto View to keep your strategy bulletproof.

For deeper tracking of stocks, IPOs, and global listings in India:

→ MoneyControl

→ RBI Bulletins

→ CoinMarketCap

Let the markets guide you — but make sure you know who’s behind the curtain.

1 thought on “Top 10 Chinese Companies Listed in Indian Stock Market”