Direct Stock SIP in India 2025: Start Investing from Just ₹500 Per Month

Direct Stock SIP in India 2025 is revolutionizing how savvy investors enter the equity market, letting them invest in individual stocks with as little as ₹500 per month. In a year marked by global rate hikes, elevated oil prices, and renewed PSU margin scrutiny, retail investors are searching for disciplined strategies to build long-term wealth without ceding control to fund managers or exposing themselves to concentrated sector risks. India’s Direct Equity SIP boom is the answer—offering both smart positioning in strong stocks and unmatched flexibility. Here’s a confident guide to mastering this trend for 2025.

The Indian markets in 2025 are not for the faint-hearted. Oil prices remain volatile, global bond yields are creeping higher, and risk appetite swings between crypto rallies and PSU margin compression. Yet amid this uncertainty, one trend is quietly reshaping retail participation: Direct Stock SIP in India 2025. With as little as ₹500 per month, investors can now buy shares directly—no fund manager, no middleman—just disciplined ownership of India’s fastest-growing companies.

This isn’t just about affordability; it’s about taking control of wealth-building in a market driven by domestic liquidity, digital platforms, and millennial investors hungry for direct exposure.

What is Direct Stock SIP in India 2025?

A Direct Stock SIP allows investors to systematically invest in individual stocks at fixed intervals—usually monthly—just like a mutual fund SIP. The difference? Instead of buying units of a fund, you directly accumulate shares of chosen companies.

In 2025, platforms like Zerodha, Groww, Upstox, and Paytm Money have made Direct Equity SIP in India seamless, allowing anyone to invest in stocks with ₹500 and gradually build a portfolio of blue-chips, midcaps, or even dividend-paying giants.

Unlike a one-time bulk purchase, SIP in stocks India lets you average out your entry price and stay disciplined, no matter the market mood.

How to Start Investing in Direct Stock SIP with ₹500

The democratization of equity investing now lets virtually anyone get started with just ₹500 per month. Here’s a stepwise process:

Open a Demat and Trading Account: Choose a leading broker/platform like Zerodha, Groww, Upstox, or ICICI Direct. (Check out our analysis of (best investment apps 2025).

Select the Stock SIP Option: Modern apps allow you to search for Direct Stock SIP or similar features. Ensure the minimum SIP amount for your shortlisted stocks matches your budget.

Pick Your Stock(s): Prioritize fundamentally strong companies—look for solid financials, profitability, and growth trajectories.

Set Amount, Frequency, and Date: Automate investments as low as ₹500 in stocks of your choice; schedule it monthly, weekly, or quarterly.

Track, Pause, or Edit Anytime: Most brokers allow pausing, changing, or stopping your SIP with just a few clicks.

Related reading: How to Invest in Nifty 50 Index Fund 2025

📌 Tip: Beginners can start with a fractional shares strategy if available. Read more on fractional shares in India.

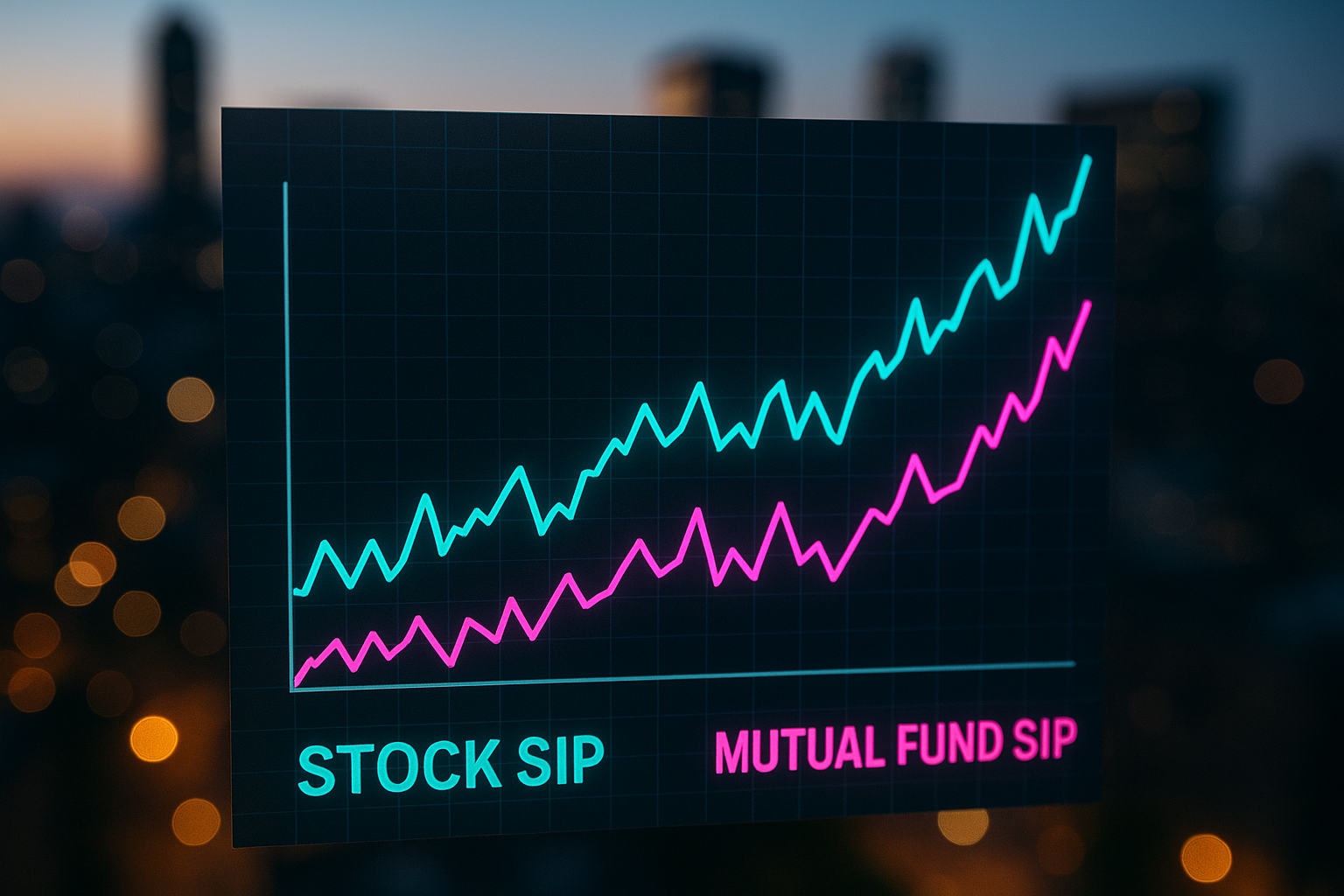

Benefits of Direct Stock SIP vs Mutual Fund SIP

Direct stock SIPs and mutual funds both promote discipline—but the control, ownership, and flexibility differ sharply.

Low Entry Point: Start with ₹500

You no longer need lakhs to build a direct equity portfolio. Stock SIP democratizes ownership.

Disciplined Investing Approach

Markets will rise, crash, and consolidate. SIPs ensure consistency—removing the emotional trap of timing.

Compounding & Long-Term Wealth

Holding quality companies for a decade via SIP can generate wealth at par or above mutual funds, especially when dividends are reinvested.

Direct Ownership of Stocks

Unlike mutual fund SIPs, you directly hold the shares—giving you voting rights, dividends, and liquidity flexibility.

👉 Related Reading: Dividend stock portfolio strategy

Best Platforms & Apps for Stock SIP in India 2025

Investors in 2025 have multiple apps to choose from:

- Zerodha – Simplified SIP setup, strong analytics, seamless integration.

- Groww – Beginner-friendly, offers stock + mutual fund SIPs.

- Upstox – Aggressive on pricing, strong mobile experience.

- Paytm Money – Easy interface, quick auto-debit SIPs.

Each has its pros, but ensure you pick platforms that allow auto-invest execution and provide research-backed insights.

📺 Suggested Video: How Stock SIP Works in India

Risks & Things to Know Before Starting Stock SIP

Stock SIP is powerful but not risk-free.

Market Volatility

Unlike mutual funds, there’s no professional cushion—your stocks fall, your portfolio bleeds.

Stock Selection Risk

Choosing the wrong company can destroy wealth, even if you SIP for years.

No Diversification Like Mutual Funds

Direct equity SIPs lack the built-in diversification of mutual funds. Investors must balance across sectors and stocks.

👉 Related Strategy: Bank Nifty weekly options strategy

Tax Implications of Stock SIP in India

Every SIP installment buys new shares—each treated as a separate investment for tax purposes:

- Short-Term Capital Gains (STCG): 15% tax if sold within 1 year.

- Long-Term Capital Gains (LTCG): 10% tax on profits exceeding ₹1 lakh annually after 1 year.

- Dividends: Taxed as per individual slab.

Learn more: Long-term vs short-term capital gains tax in India.

Is Direct Stock SIP the Future of Investing in India?

With over 12 crore demat accounts in 2025, the appetite for direct stock ownership is exploding. Mutual funds remain popular, but direct equity SIP is gaining traction among Gen-Z and millennial investors seeking control, flexibility, and transparency.

Given India’s structural growth story—manufacturing, digitization, banking reforms—Direct Stock SIP India 2025 could well be the bridge that allows small-ticket investors to participate in wealth creation at scale.

For those who can stomach volatility and do homework, this is the future of equity investing.

FAQ: Direct Stock SIP in India 2025

Q1. What is the minimum amount required to start a Direct Stock SIP in India 2025?

You can start with as little as ₹500 per month per stock. Some platforms may even allow fractional share investing, lowering the entry barrier further.

Q2. How is Stock SIP different from a Mutual Fund SIP?

A mutual fund SIP invests in a professionally managed basket of stocks, while a stock SIP buys shares of your chosen companies. Stock SIP gives control and ownership, but requires research and carries higher risk.

Q3. Which are the best apps for Stock SIP in India 2025?

Popular apps include Zerodha, Groww, Upstox, and Paytm Money. Each allows easy auto-debit and systematic stock purchase. Choose based on fees, interface, and research support.

Q4. Is investing ₹500 in Stock SIP monthly enough?

Yes, if done consistently for 10–15 years in fundamentally strong companies. ₹500 SIPs may look small today, but compounding and dividend reinvestment can create significant long-term wealth.

Q5. What are the risks of Direct Stock SIP?

Main risks include market volatility, wrong stock selection, and lack of diversification. Unlike mutual funds, there’s no fund manager to balance risk.

Q6. Can I change or stop my Stock SIP anytime?

Yes. Stock SIPs are flexible—you can increase, reduce, pause, or stop anytime without exit load.

Q7. How are taxes calculated on Stock SIPs in India?

Each SIP purchase has its own holding period. If sold within 1 year, STCG at 15% applies. After 1 year, LTCG of 10% applies on profits exceeding ₹1 lakh annually. Dividends are added to your income slab.

Q8. Should beginners choose Stock SIP or Mutual Fund SIP in 2025?

Beginners may start with mutual fund SIPs for diversification. But if you are confident in stock research, Stock SIP is a great way to build direct ownership in India’s growth story.

Q9. Can Stock SIPs beat mutual fund SIP returns?

Yes—if you pick outperforming companies. But they can also underperform if your stock choices fail. Discipline + selection are critical.

Q10. What sectors are ideal for Stock SIP in 2025?

Banking, FMCG, IT services, EV/renewable energy, and capital goods are long-term themes worth considering. However, diversify across 4–5 sectors to reduce risk.

🔗 Outbound Reference: NSE India on Systematic Investment Plans

3 thoughts on “Direct Stock SIP in India 2025: Start Investing from Just ₹500 Per Month”