Crypto Batter: The Digital Power Surge Investors Can’t Ignore in 2025

Crypto batter is gaining traction as the next big investment trend. Discover how it’s reshaping markets, from BTC to regulation, and what smart investors need to know.

Volatility Is Not the Enemy—It’s an Opportunity Zipper

Welcome to July 2025.

Oil prices are bouncing off geopolitical cliffs. The Strait of Hormuz remains a chokepoint, and Iran’s unpredictable posture means 20% of the global oil supply could vanish overnight. While traditional equity investors nervously rebalance gas distributors and refiners, crypto-focused traders are whispering a new term: crypto batter.

What is it? Why is it dominating speculative circles? And can it really deliver asymmetrical upside in a portfolio where every basis point counts?

Let’s decode this with sharp, real-time insights for serious investors.

Table of Contents

- What Is Crypto Batter?

- Stock Market Update: July 2025 Snapshot

- Crypto Market Breakdown: BTC, ETH, and Beyond

- India’s Regulatory Eye on Crypto Batter

- RBI’s Latest Moves: Inflation, GDP & Repo Rate

- Risk or Opportunity? Smart Hedge Ideas

- Final Take: Is Crypto Better Worth Your Bet?

- FAQs on Crypto Batter

- Image & Video Suggestions

What Is Crypto Batter?

At first glance, “crypto batter” might sound like a culinary experiment. But in the finance world, it’s the new-age term for highly blended crypto products—part utility token, part stablecoin, and part smart contract-based reward model.

These instruments “batter” together various blockchain components to:

- Enhance transaction scalability

- Minimize volatility (through algorithmic stabilizers)

- Blend speculative potential with DeFi utility

Think of it as the DeFi ETF of 2025, but built natively on the blockchain. Ethereum-based platforms are the primary testbed, but Solana and Polygon are catching up.

Stock Market Update—July 22, 2025

While crypto chatter buzzes, traditional markets are walking a tightrope.

- Nifty 50: 23,810 ▲ +0.85%

- Sensex: 79,420 ▲ +0.78%

- Top Movers:

- Infosys +3.2% (on solid Q1 earnings)

- ONGC -2.5% (margin pressure due to falling oil refining spreads)

- Zomato +4.1% (FTSE Smallcap inclusion)

📌 Internal link suggestion: [Nifty 50 Weekly Outlook]

With fears of crude price hikes, domestic FMCG stocks like HUL and Dabur are being watched for inflation pass-through strength.

Crypto Market Analysis: BTC, ETH, and Crypto Batter

Bitcoin (BTC) has rebounded 6.4% in July, hovering around ₹51,20,000 ($61,400). Ethereum (ETH) is up 3.8% at ₹310,000 ($3,720).

But the real action? It’s in crypto barter tokens—particularly ones tied to reward-based smart contracts. These Batter tokens are being used in play-to-earn gaming, cross-border settlements, and AI-driven predictive exchanges.

Top Crypto Batter Trends:

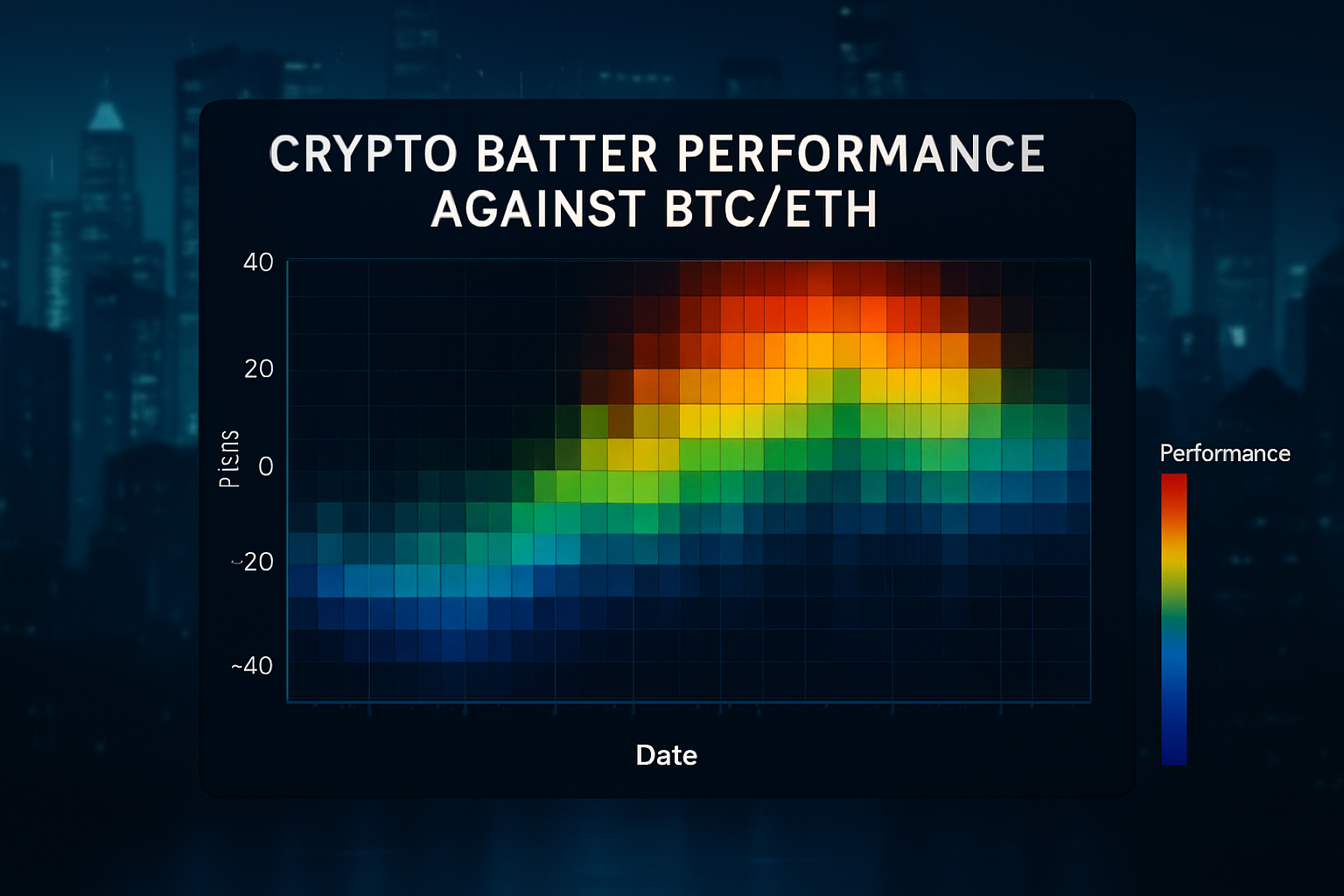

- BATX (Batter Exchange Token) on Solana has risen 40% MoM.

- DEBATT (Decentralized Batter Basket) now accounts for 3.5% of Binance’s monthly trade volume.

- Cross-chain compatibility is emerging as a key driver.

📌 : CoinMarketCap – Trending Tokens

India’s Regulatory Position on Crypto Batter

The Indian government, under SEBI and the RBI, is cautiously optimistic. While blanket bans are off the table, KYC integration and self-declaration mechanisms are being proposed for crypto batter platforms.

What’s driving this? The crypto barter economy is finding favor among Tier-II cities, where digital wallets and mobile-first investments are surging.

Key updates:

- SEBI’s Crypto View: No outright restriction, but new risk disclosures will be required.

- The GST Council is mulling an 18% slab on crypto barter transactions involving NFTs.

📌 : [SEBI’s Crypto View – July 2025 Policy Tracker]

RBI Update—July 2025

India’s central bank remains cautious yet watchful. Here’s what matters:

- Repo Rate: Maintained at 6.50%

- Inflation: Slowed slightly to 4.81% YoY

- GDP Forecast: Revised upward to 6.9% for FY25

The RBI Governor stated in the July 15 press briefing:

“Innovations like crypto batter must be observed closely. They offer promise but require guardrails.”

📌 External link: RBI Official Site – Monetary Policy Press Release

Risk or Opportunity? Should You Add Crypto to Your Portfolio?

Let’s lay out the landscape:

✅ Why Consider Crypto Better?

- Exposure to multi-chain growth in one product

- Early-stage momentum similar to ICOs (2017) or DeFi (2020)

- Algorithmic guards reduce volatility impact

⚠️ Risks to Note

- Regulatory grey zones

- Illiquid secondary markets for newer batter tokens

- Smart contract flaws

But if you’re a high-risk investor with a 2–3 year horizon? Crypto batter could be the asymmetric shot worth taking.

FAQs on Crypto Batter—2025 Investor Guide

❓ What is crypto batter in simple terms?

Crypto Batter is a hybrid blockchain financial product that blends multiple crypto features—like utility tokens, DeFi protocols, stablecoin anchors, and smart contract functions—into one powerful digital asset. Think of it as the “batter” that mixes ingredients from different crypto layers (Layer 1, Layer 2, NFTs, and DeFi) into a singular, utility-heavy investment product.

❓ Why is it called “batter”?

The term “batter” is metaphorical—just like in cooking, where different elements are mixed to form a cohesive blend, crypto batter combines aspects of various blockchain technologies into one asset. The idea is to unify the strengths of Bitcoin’s security, Ethereum’s smart contract flexibility, DeFi’s yield mechanics, and stablecoin volatility control.

❓ Is crypto better than Bitcoin or Ethereum?

Not quite. While Bitcoin (BTC) and Ethereum (ETH) are singular digital assets with distinct blockchain infrastructures, crypto batter is a synthetic instrument or packaged solution that utilizes multiple chains and protocols. It’s more like a DeFi-based crypto ETF, but entirely managed through code—no fund managers, no custodians.

❓ How does crypto barter work?

Crypto batter tokens are built on smart contracts—primarily on Ethereum, Solana, or Polygon. These contracts auto-allocate exposure to:

- Price-stable coins for hedging

- High-growth altcoins for upside

- Tokenized real-world assets (RWAs) for diversification

- Reward protocols (staking, yield farming)

Some batter tokens also use algorithmic rebalancing, adjusting their internal structure based on market movements, just like a robo-advisor but within a token.

❓ Can I invest in crypto batter from India?

As of July 2025, Indian investors can access crypto batter through international exchanges like Binance, Kraken, and KuCoin. A few Indian platforms are in beta-testing phases for listing localized versions. However, since crypto regulations in India are still evolving, you’ll need to complete KYC (Know Your Customer) and report profits as per current income tax rules.

📌 Internal tip: Check [SEBI’s Crypto View] for regulatory guidance.

❓ What are the risks of investing in crypto batter?

Like any emerging financial product, crypto barter carries both innovation and risk:

- Regulatory grey areas—India, the US, and the EU are still framing policies.

- Smart contract vulnerabilities—one bad code line can lead to massive losses.

- Market liquidity—better tokens may not be as easily tradable as BTC or ETH.

- Hype factor—early-stage tokens might ride a pump-dump cycle.

So, it’s best suited for high-risk, high-reward portfolios—not conservative retirement accounts.

❓ What is the ROI potential of crypto batter?

ROI (Return on Investment) depends on the underlying assets and contract logic. Some crypto batter tokens like BATX have returned 30–50% MoM, while others have flatlined or dropped. Asymmetric upside is possible, especially when market conditions favor multi-utility crypto products.

❓ Is crypto better regulated?

Crypto batter itself is not a regulated instrument yet. However, platforms offering them may come under the purview of SEBI (India), FCA (UK), or SEC (USA), especially if fiat on-ramp or staking rewards are involved. Keep an eye on RBI’s statements and updates on digital currencies.

📌 External link: RBI Official Site – Digital Asset Framework

YouTube Video Title Ideas

Conclusion—The Batter is Hot, But Handle It with Tongs

In 2025’s chaotic markets, clarity is alpha. While equities wrestle with earnings pressure and geopolitical unease, the crypto world is experimenting with crypto batter—a new recipe of digital speculation that could deliver explosive returns or fizzle into irrelevance.

But for sharp investors with a risk appetite, crypto batter deserves a watchlist spot.

Stay alert. Stay nimble. And never forget—volatility is just a zipper to opportunity.

Excellent article. I am experiencing some of these issues

as well..