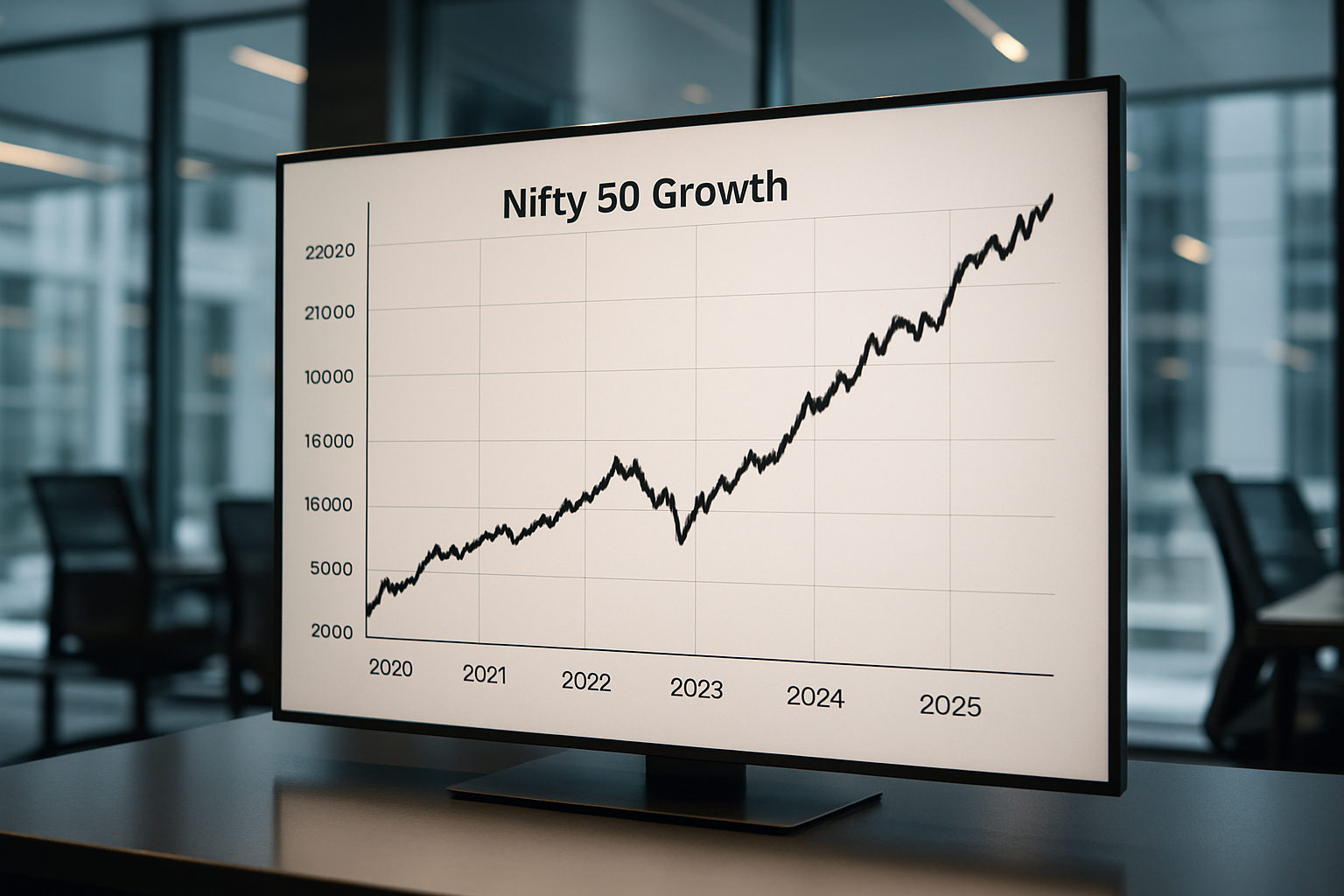

How to Invest in the Nifty 50 Index Fund in 2025 | Top Nifty Mutual Funds & ETFs in India & USA

Learn how to invest in Nifty 50 index funds in India and from the USA. Discover top index funds, mutual funds, ETFs, and strategies for 2025.

Volatility Is Not the Enemy—It’s an Opportunity Zipper

The smart money knows this: volatility isn’t your enemy. It’s your edge. In 2025, with global cues shifting daily and macroeconomic winds whistling through every asset class, you either ride volatility or get swept away by it.

For shrewd investors, this is not the time to retreat. It’s the time to position intelligently, hedge wisely, and stay nimble. The Nifty 50 index fund, India’s bellwether of economic momentum, continues to offer entry points that can reshape your portfolio.

Stay alert. Hedge smartly. Stay liquid enough to pivot. And yes—watch oil, crypto, and central bank moves like a hawk.

Why Index Investing in India Is No Longer Optional

Passive investing is no longer just the boring cousin of active strategies—it’s the disciplined sniper. In 2025, with Indian markets maturing, index investing in India is delivering competitive returns with lower expense ratios.

Top reasons index investing in India makes sense now:

- Low cost: No active fund manager fees bleeding you dry.

- Market-beating potential: Many active funds have failed to beat the Nifty 50 in the last 5 years.

- Diversification: You get exposure to 50 of India’s most traded companies—instantly.

- Transparency and simplicity: Know exactly what you own with a Nifty index fund.

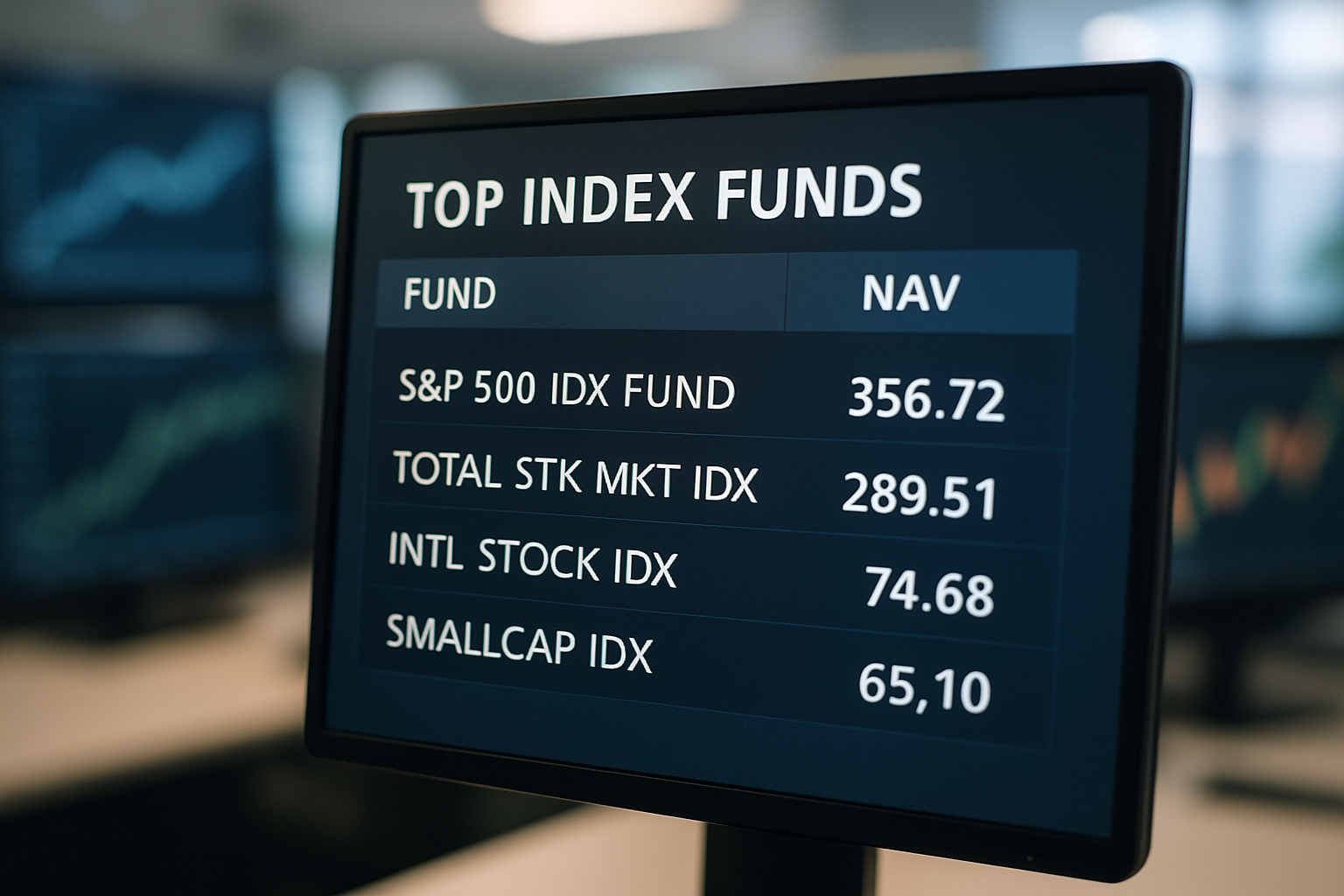

Best Nifty Index Funds to Watch in 2025

Looking for the top index funds in India right now? Here are the top-performing Nifty 50 index mutual funds you should consider:

1. Nippon India Nifty 50 Bees ETF

- Type: Exchange-Traded Fund (ETF)

- Expense Ratio: ~0.05%

- Ideal For: Investors seeking liquidity and real-time trading.

- Keyword Focus: nifty index fund, nifty fund

2. ICICI Prudential Nifty Index Fund

- Type: Mutual Fund

- Expense Ratio: ~0.18%

- Highlights: Strong AUM and low tracking error.

- Keyword Focus: nifty 50 mutual fund

3. HDFC Index Fund – Nifty 50 Plan

- Type: Direct Growth Plan

- Expense Ratio: ~0.20%

- Ideal For: Long-term SIP investors.

- Keyword Focus: nifty 50 fund, investment in nifty

4. UTI Nifty 50 Index Fund

- Solid long-term performance

- Consistent rebalancing with market cap changes

- Keyword Focus: nifty mutual fund

Explore latest index fund NAVs on MoneyControl

Nifty Market Update: Mid-July 2025 Snapshot

Nifty 50

- Current Level: 24,320

- YTD Return: +12.4%

- Volatility Index (India VIX): 15.3 (mildly elevated)

Sensex

- Current Level: 81,450

- Top Gainers: Reliance Industries, Infosys, Bajaj Finance

- Top Losers: Adani Enterprises, NTPC, Hindalco

Playbook: Take partial profits in cyclical winners. Stay invested in consumption & financial services.

For detailed weekly movements, read Nifty 50 Weekly Outlook

RBI Pulse: Macro Moves That Matter

GDP Forecast

- FY25 GDP Estimate: 6.9% (unchanged)

- Manufacturing: Slight uptick

- Services: Strong performance, especially in IT and fintech

Inflation Outlook

- CPI Inflation (June 2025): 5.3%

- Core inflation easing, but food prices remain sticky

Repo Rate

- Current Rate: 6.25%

- RBI Stance: “Withdrawal of accommodation”

- Next Policy Meet: August 2025—rate pause likely

Track updates from the RBI Official Site

How to Invest in Nifty 50 in India: Simple Steps

Many investors ask, how to invest in Nifty 50 India? Here’s your step-by-step answer:

- Choose a Platform: Groww, Zerodha, Upstox, Paytm Money

- Pick a Fund Type:

- Mutual Fund (Direct Growth) for SIPs

- ETF for real-time trading

- Start SIP or Lump Sum

- Track Performance quarterly—not daily

Pro tip: Set a monthly SIP in a top-performing Nifty 50 mutual fund to build wealth consistently.

How to Buy the Nifty 50 Index

If you’re wondering how to buy the Nifty 50 index, it’s easier than you think:

- Open a demat and trading account with a SEBI-registered broker

- Search for ETFs or mutual funds with “Nifty 50” in their name

- Choose between a lump sum investment or an SIP.

Popular options:

- Nippon Nifty 50 Bees (ETF)

- HDFC Nifty 50 Plan (Mutual Fund)

How to Invest in Nifty 50 from the USA

Yes, global investors often search for how to invest in Nifty 50 from the USA. Here’s how:

- Open a global investing account with Vested or Stockal

- Use an NRE/NRO account with Indian brokers like Zerodha

- Buy ETFs with Indian exposure (like iShares MSCI India ETF – INDA)

Ensure compliance with:

- Indian FEMA guidelines

- U.S. taxation and reporting laws

Stay aware of currency risks when investing in Indian rupee-denominated funds.

Nifty Mutual Funds vs. ETFs: What’s Right for You?

| Feature | Mutual Fund | ETF |

|---|---|---|

| Expense Ratio | Slightly higher | Very low |

| Trading | End-of-day NAV | Real-time, like stocks |

| SIP Option | Yes | Not always |

| Liquidity | High (but not instant) | Instant |

If you’re a beginner, start with a Nifty mutual fund via SIP. If you’re an experienced trader, ETFs offer intraday flexibility.

Investment Strategy: Beyond Nifty

Oil-Linked Plays

- Watch Margin Pressure: Gas distributors and refiners may see earnings hit if oil spikes.

- Actionable Idea: Pare positions in HPCL, IOC. Hedge via energy ETFs.

Crypto Moves

- BTC Price (July 2025): $64,800

- ETH Price: $3,750

- Indian Stance: Regulatory sandbox for tokenized assets, taxation clarity still awaited

Slight BTC/ETH overweight could offer asymmetrical upside—IF your risk appetite allows.

Stay updated on CoinMarketCap

Risks to Watch: Strait of Hormuz & Global Oil Supply

If tensions in the Middle East escalate—specifically around the Strait of Hormuz—expect:

- Oil price shock: Up to $120/barrel

- Global equity drawdowns

- INR weakness, import cost pressures

Action Plan:

- Hold cash equivalents or gold ETFs

- Buy Nifty on dips cautiously

- Hedge large caps via index options

Final Word: Why Nifty 50 Index Fund Is Still the Smartest Core Holding

Smart investors don’t chase trends—they ride megatrends. And Nifty 50 index funds are India’s ultimate economic megatrend.

Whether you’re a domestic investor with SIP discipline or an NRI seeking INR-linked exposure, the Nifty 50 fund offers a time-tested, cost-efficient entry into India’s market growth story.

So if you’re considering investment in Nifty, start now with a low-cost Nifty mutual fund or ETF.

Let the noise pass. Focus on structure. Nifty 50 is your India engine.

Suggested YouTube Video

Internal Links to Include:

Outbound Links:

FAQ Section

Q: Is it safe to invest in Nifty 50 index funds in 2025?

A: Yes, they offer broad market exposure with lower cost, making them a smart choice for long-term investors.

Q: Which is better: Nifty mutual fund or ETF?

A: Mutual funds are great for SIPs and simplicity. ETFs are better for real-time traders.Q: Is the Nifty 50 index fund a good investment in 2025?

A: Yes, it offers diversified, cost-efficient exposure to India’s top 50 companies.Q: Can NRIs invest in Nifty 50 index funds from the USA?

A: Yes, through NRE/NRO accounts or international investing platforms like Vested.Q: What’s the difference between a Nifty ETF and mutual fund?

A: ETFs trade like stocks in real time; mutual funds are bought/sold at NAV.

Read Also—How to Avoid Emotional Investing in the Stock Market