Bank Nifty Weekly Options Strategy Explained (with Examples)

Volatility is not the enemy—it’s an opportunity zipper.

The Indian markets have evolved. So have the traders. And nowhere is this evolution more evident than in the way sharp market participants now use Bank Nifty weekly options—not just to speculate, but to hedge, earn, and strike when the iron is hot.

Whether you’re managing a short-term portfolio or just eyeing a side income from premiums, mastering Bank Nifty weeklies is a skill every serious trader needs in 2025. But don’t walk in blind—this isn’t the same game it was even two years ago.

Let’s break it all down—from strategy to psychology and from India’s macro lens to the global tremors that shape expiry moves.

🔍 Market Pulse: June 2025

Before diving into the trading playbook, let’s anchor ourselves in the current landscape.

📊 Nifty, Sensex, and Sector Watch

The Nifty 50 index is grinding near 23,730, while Sensex hovers around 78,260. These numbers don’t reflect chaos, but they do mask rotation—money is moving under the surface.

Top Weekly Gainers:

- Adani Ports: +6.1% (boosted by better-than-expected export numbers)

- Kotak Mahindra Bank: +5.2% (post-restructuring buzz)

- L&T Finance: +4.6% (credit growth momentum)

Notable Drags:

- Hindustan Unilever: -3.9% (input cost pressure, especially palm oil)

- ONGC: -2.7% (global oil volatility affecting upstream focus)

💡 RBI Signals to Watch

The Reserve Bank of India is playing the long game.

- Repo Rate: Static at 6.50%—a signal that RBI is data-dependent, not reactive.

- GDP Growth Projection FY26: Revised upwards to 7.2%, driven by capex revival and services.

- Inflation Forecast: Sticky at 5.1%—especially food inflation is proving hard to tame.

RBI’s tone is moderately hawkish. Any surprise upside in inflation could spark bond volatility—and that matters for banks. Stay alert.

⚡ Why Bank Nifty Weekly Options Matter

In a market where timing is alpha, the Bank Nifty weekly options index is the sharpest weapon in the derivatives arsenal.

- Liquidity: Ultra-tight spreads, lightning-fast fills.

- Expiries Every Thursday: Each week = new opportunity.

- Macro Sensitivity: Banks react faster to monetary cues than Nifty as a whole.

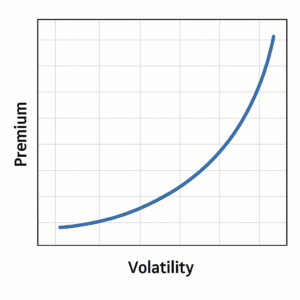

- Volatility = Opportunity: Big swings mean big premiums (if played right).

Bank Nifty is like a coiled spring. You either master its energy or get whipped by it.

🧠 Strategy 1: The Iron Fly—”Fly When IV’s High”

Use When:

- IV (implied volatility) is elevated but expected to cool.

- No RBI or major global data is expected mid-week.

Structure:

- Sell ATM Call + Sell ATM Put

- Buy OTM Call + Buy OTM Put (equidistant from ATM)

📘Example:

Bank Nifty is at 51,200 on Monday.

- Sell 51,200 CE & 51,200 PE

- Buy 51,800 CE & 50,600 PE

- Net Premium Collected: ₹360

- Max Profit: ₹360

- Max Loss: ₹240

- Breakevens: 50,840 and 51,560

When to Exit:

- If the price stays within range till Wednesday EOD, book 50–70% of the profit.

- If a breakout occurs, cut losses—don’t pray.

💡Pro Tip:

Use the IV percentile filter—execute this strategy only when the IV percentile is > 60.

💣 Strategy 2: Tuesday Short Straddle—”The Theta Assassin”

Use When:

- No known event risk mid-week

- Bank Nifty has consolidated in a tight range on Monday-Tuesday

Structure:

- Sell ATM Call and ATM Put on Tuesday EOD

- Set defined SL on both legs

📘Example:

Bank Nifty = 51,000 on Tuesday evening.

- Sell 51,000 CE and PE

- Premiums Collected: ₹410

- SL per leg = ₹150

- Breakeven zone: ~±300 points

Edge:

You collect time decay premium right in the sweet spot—midweek. Time decay is fastest here, and you enter after initial direction settles.

Risk:

Avoid this on Fed week, RBI policy, or any major US CPI/FOMC week.

📈 Strategy 3: Bull Call “Ladder”—“Profitable Calm, Controlled Surge”

Use When:

- You expect moderate bullishness

- Want limited downside risk but still seek credit

Structure:

- Buy an ATM call.

- Sell 2x OTM Calls

📘Example:

Bank Nifty at 50,800

- Buy 50,800 CE

- Sell 51,200 CE × 2

- Net Credit: ₹40

Payoff:

- Best scenario: expiry between 51,100 and 51,300

- Break-even zone wide enough

- Risk begins only above 51,600 (use hedge if needed)

Advanced Tip:

Convert into an Iron Condor by adding a put leg if you’re neutral.

🛡️ Strategy 4: Protective Put—”Hedge the Swings, Not Your Confidence”

Let’s say you hold SBI, Axis, and ICICI in your core portfolio. You believe in them long-term but fear short-term drawdowns due to RBI action or geopolitical risk.

The answer? Buy a short-dated put on Bank Nifty.

📘Example:

You own ₹12 lakh worth of bank stocks.

Buy 1 lot (15 units) of 50,800 PE @ ₹110

Cost = ₹1,650 for 1-week protection.

If Bank Nifty tanks 400 points, this put could go to ₹400—that’s a ₹4,350 payout for a 1.6k cost.

Use protective puts not as panic buttons but as shock absorbers.

🌍 Macro Risk Map: Oil, Geo-Risk & Crypto

🛢️ Strait of Hormuz = Strait of Fire

With Iran-Israel tensions rising again, the Strait of Hormuz remains under watch. Why should you care?

- 20% of global oil flows through this route.

- If Iran blocks or disrupts it, Brent could spike above $110

- India = net oil importer → CAD, INR, fuel inflation all get hit

- Result: Bank stocks with high loan exposure may underperform

📉Playbook:

- Short Refiners or use put spreads

- Go long USDINR via options

- Add “Oil ETF” exposure (via mutual funds or thematic ETFs)

🔗 Crypto Checkpoint

BTC and ETH are consolidating smartly.

- BTC: ₹50.3 lakh

- ETH: ₹2.4 lakh

- Strong support zones: BTC ₹47–48L, ETH ₹2.1–2.2L

India’s SEBI is warming up to regulated access through sandboxed ETFs. No hard ban. Just cautious optimism.

Tactical View:

If your risk appetite allows, consider

- 5% allocation to crypto SIP (BTC/ETH)

- Use dips to accumulate

- Avoid altcoins for now—wait for SEBI clarity

Explore more: CoinMarketCap

RBI Official Site—monetary policy updates

CoinMarketCap—live BTC/ETH rates

Moneycontrol—stock market data and earnings calendar

❌ Common Mistakes Traders Must Avoid

- Zero SL Trading:

Hope is not a strategy. Risk-defined trades only. - Overleverage:

One wrong expiry can dent your entire monthly ROI. - Trading All Expiries:

Be selective. Skip weeks where macro landmines are hidden. - Gamma Neglect:

Gamma = speed of delta change. Important for intraday expiry trades. - Ignoring Global Cues:

Bond yields, USDINR, and US VIX—they affect Nifty Bank’s tempo.

📆 Weekly Expiry Blueprint—Rituals of a Smart Trader

| Day | Focus |

|---|---|

| Monday | Trend setup, scan for IV, macro prep |

| Tuesday | Entry day for straddles/spreads |

| Wednesday | Adjust positions, tighten risk |

| Thursday | Exit by 2:30 PM—avoid expiry trap |

| Friday | Crypto review, prep next week’s bias |

🎬 YouTube Video Idea

READ

- [Nifty 50 Weekly Outlook]—for broader market cues

- [SEBI’s Crypto View]—Evolving Regulatory Landscape in India

🧭 Final Words: Trade Like a Hawk, Not a Headless Chicken

Bank Nifty weekly options are not just about speed. They’re about discipline, clarity, and macro awareness.

Each expiry is a clean slate—your edge isn’t just in your view but in how quickly you adapt when you’re wrong. Be nimble, hedge actively, and treat every Thursday as a test of precision.

Volatility is your vehicle. Risk control is your seatbelt.

Use both—and you’ll not just survive, but thrive.

FAQ

Q1: What is the best Bank Nifty weekly options strategy?

A1: It depends on volatility and trend. Iron Fly for range-bound, Straddle for theta decay, and Ladder for mild directional bias.

Q2: Can beginners trade Bank Nifty weekly options?

A2: Yes, but start with defined-risk spreads like Iron Condor or credit spreads. Avoid naked selling.

Q3: Is Bank Nifty safer than Nifty for weekly options?

A3: Bank Nifty offers more premium due to volatility, but it also requires tighter discipline. It’s more rewarding but riskier.